The litany of great financial scandals is long, and sadly unending. Dickens himself covers scandals we would recognise today in Little Dorrit and Nicholas Nickleby. Beyond Dickens, the South Sea Bubble (of course), railway shares, bonds in newly independent countries (Kingdom of Poyais), never again... IOS, Saavundra, Rolls Razor, Bank of Gibraltar, BCCI, never again... endowment mortgages, Barlow Clowes, Equitable Life, Maxwell, Lloyd's names, Lehman Brothers, payment protection insurance, never again... This symposium seeks, through the ghosts of scandals past, present and future, to see what lessons we can learn and to assess which is rosier, the future of finance or of financial scandals.

10 January 2013

What the Dickens?

Some thoughts on City Scandals

Professor Tim Connell

One of the key problems with City scandals, whether current or historical, is the damage that they cause to reputation and hence to far more people than those who are involved originally. Such scandals can also cause untold damage to the commercial activity itself.

This is clearly illustrated by a historic event which, at first sight, may seem somewhat removed from the Square Mile. I should perhaps note here that I wrote my thesis on income tax – something which has made me welcome in more than one business school. Until, that is, I have to admit that I wrote about income tax in the Aztec Empire. There are actually more parallels than may at first appear, and I make it a rule for my contribution to a symposium never to overlap with what the other speakers might want to say. Not to digress, the Aztecs set up an empire based on conquest and levying tribute from subject peoples, in an area that today covers Mexico and parts of Central America. The key point is that they set their rates of taxation at a figure that the locals could afford which, oddly enough, came out at about twenty per cent, not unlike the quinta real, the one fifth taken by the Spanish Crown on all overseas ventures, and of course rather like VAT today. When the Spaniards arrived, they were overwhelmed by the sheer wealth of the region, but in thirty years the damage had been done: the population fell in less than one hundred years from around fifty million to fewer than two million: European diseases, ill-treatment and social disruption had caused a catastrophe. The Spanish response was to set up two Royal Commissions, one in the 1550s and another a decade later. They key question that emerged was: what tribute had been paid to the Aztecs and in what form? From this a sustainable system emerged which was reinforced by the Bourbon reforms in the Eighteenth Century, and was commented upon by the early scientist Alexander von Humboldt when he visited New Spain in 1810, ironically on the eve of the War of Independence, which led to a further lengthy period of instability.

The key point is that no-one initially thought how best to exploit the system in a sustainable fashion, to allow for long-term wealth and prosperity, rather than the one-off impact of plunder and rapine. And many people did know better: the first laws to protect the inhabitants in the Indies were passed in 1512, and there were more in 1542. But vested interests in the meantime were too strong, and central authority too weak to establish proper systems of control. So there are perhaps more parallels here to today’s topic than might at first have appeared!

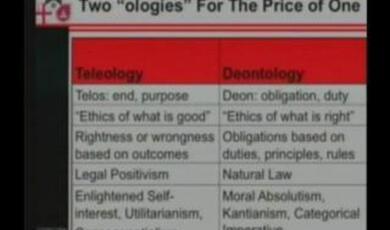

Ultimately, it seems to me that there are two methods of control: the external one of regulation, backed up by sanction, which appears to be very difficult to get right. If the regulation is too fierce, then it will simply drive people away, and if it is too lax, then someone will find a way to get round it, and then the danger is that it will simply be ignored.

The other method is essentially internal: people do not knowingly break the law, at least not regularly and in large numbers, because they are aware of the long-term damage to their produce, their company or the market. “My word is my bond” is no more than a pleasant memory, and although the thought of social sanction or ostracism might have been enough to keep people generally on the straight and narrow, it did not deter the avowedly criminal from pursuing their own ends, and history is full of collective mania, ranging from railway shares to the dot.com bubble.

All this puts me in mind of a market trader I once knew. Louis did not work in a City exchange – he was a genuine market trader somewhere in South London. He was a permanent fixture, liked, respected and even a little feared by the people who knew him. And sometimes people who didn’t know him would come up with an offer or a deal that he knew to be bogus or dodgy. With a twinkle in his eye, he would simply say, “Yeah, I should oko boko!” which is, of course, a variant on the Cockney phrase “I should cocoa”. It encompassed a number of things: I wasn’t born yesterday; what kind of fool do you take me for; and I’m not that daft.” And Louis prospered – indeed, he retired in his old age to Canvey Island.

So in his memory, I would like to present to a Gresham audience the Oko Boko Principles of Banking:

If it looks too good to be true, then it probably is.

High rewards equal high risks – and high risks may break the law.

Some get rich quick – so others get poor quicker.

Or can we perhaps sum it up by saying, “The quick buck stops here – and now”. Even if you take more than enough for yourself, then you should leave something for the next person, and leave the market still intact. Whatever the activity, it should not leave damage in its wake.

Perhaps none of that would have stopped the Black Tulip, the South Sea Bubble or even Gulliver’s Projectors. And however much we regulate, I rather fear that the next Rolls Razor, Emile Savundra, Ponzi scheme or Salami swindle will still somehow get through. But it is up to everyone to ensure that the City of London restores and maintains its reputation as a major world trading centre. We will all be the poorer for it if not.

© Professor Tim Connell 2013

Login

Login