Markets in their Place: Moral Values and the Limits of Markets

Share

- Details

- Transcript

- Audio

- Downloads

- Extra Reading

The aim of this lecture is to be both self contained but also an introduction to the other lectures. Market based orders are usually thought of as embodying a sense of individualism and moral subjectivism. At the same time there is unease about both the moral basis of markets as well as their limits. How are we to understand the moral basis of markets - for example of property rights since markets are essentially exchanges of property rights, the role of trust in economic exchange and questions of justice in relation to markets? Throughout these lectures we shall consider what place if any religious thinking about such matters can play in a liberal pluralistic society.

This is a part of the lecture series, Religion and Values in a Liberal State.

The other lectures in this series include the following:

Markets, Freedom and Choice

Just Markets

Selling Yourself Short: The Body, Property and Markets

What's it Worth? Values, Choice and Commodification

Trust in Markets?

Download Transcript

9 October 2012

Markets in their Place:

Moral Values and the

Limits of Markets

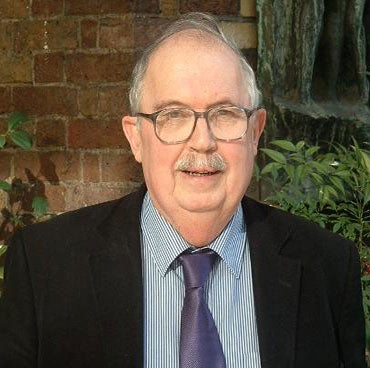

Professor The Lord Plant

This cycle of lectures over three years will look at the role of religion and specifically Christianity in a modern liberal and to a substantial extent secular state. Next year my theme will be the role of religion in public life and the relationship between the requirements of a common sense of citizenship on the one hand and a specific religious identity on the other. It is often argued that in a liberal state religion should be seen as a wholly private matter and that religion has no place in the public realm and the public deliberation about policy. In the subsequent year we shall look in some detail about the relationship between religion and modern forms of culture and in particular between religion and what might be thought of as secular reason which is embodied particularly in modern science but by no means exclusively so. This year however I want to concentrate on what religious thought might be able to contribute to our understanding of economic life. The market economy is an essential feature of a liberal society but at the same time there has been something of a crisis of confidence in liberal capitalist economics and the role of moral values in a market order. These sorts of issues are now debated incessantly and passionately. In the current series of lectures I shall try to tease out a whole range of moral issues related to the understanding of the modern economy and what contribution if any Christian thought can make to dealing with such issues.

In this lecture I shall consider what might be regarded as the moral limits of markets. As with most institutions, the very legitimacy of the market may well depend on recognising that markets have to operate within certain boundaries and that they will lose their legitimacy if they operate beyond those limits. This lecture will be self contained but it will point to issues to be discussed in much more detail in later lectures.

First of all though I want to start with quite a well known anecdote. When the Churches made various kind of intervention in the debates about the general strike in 1926 Baldwin said that this was about as appropriate as what was then the Federation of British Industry, now the CBI setting up a committee to revise the Athanasian Creed. Behind this observation lay the view that economics was to be seen as a wholly technical matter to be left to economists and business people and that there was no place for the moralist or for a religious view of the free market order. I think that this is a profoundly mistaken view. There is certainly a widespread view around at the moment that the present crisis in the free market order is as much a moral one as anything else and there is a lot of debate about trust, promise keeping and probity in markets. Indeed this last issue was central to the report recently produced by the new chair of the Financial Conduct Authority on the Libor scandal. The nature of the market order does raise questions of profound moral and as we shall see as the lectures progress religious concern which cannot be displaced by an insistence on the independence of the market order from morality and an insistence that questions about the market order are in fact of a wholly technical sort.

My theme in this lecture is how if at all might we plot the limits of markets. In the 1970’s the theory of government overload was popular. The claim was made that the British government had lost some of its authority because, since the Second World War, its role and function had been extended into areas that were not of central concern to government and in which its competence was limited. Part of the programme of Mrs Thatcher was to increase the legitimacy of government by narrowing its scope and increasing its authority in a narrower area. Whether this project has been successful is not a matter for discussion here. What I am suggesting, however, is that something similar could happen in the case of markets. If markets and the motivations which markets rely on are extended in an uncritical way, then it is possible that they too could come to lose legitimacy, even in areas where they are appropriate. This lecture should not, therefore, be construed as an anti-market one. Rather, I am concerned with making sure that the market, which has an absolutely necessary function in a free and pluralistic society, does not jeopardise people’s loyalty by being continually extended into areas in which its legitimacy might be questionable.

I believe that it is possible to identify three sorts of moral boundaries to markets. There may, of course, be more, but quite a lot is caught by the following: the moral underpinnings of markets, the moral boundaries to the sphere of markets; and the moral consequences of markets.

Moral Underpinnings

In talking of the moral underpinnings of markets, I have in mind the idea that in order to work effectively the market requires certain moral attitudes on the part of those involved, and that there is some danger of these moral underpinnings being disturbed by markets themselves, thereby striking at the roots of their own effectiveness and efficiency. I shall discuss two examples of this, although no doubt there are others.

The first is that, although market relations undoubtedly rest upon self-interest, they equally rest upon contract; and contractual relations in turn depend upon a set of indispensable moral attitudes of trust, promise-keeping, truth-telling and taking-one’s-word-as-one’s-bond. As Emile Durkheim once pointed out, all that is in the contract is not contractual. That is to say, for contractual relations to work effectively, there has to be in place a set of moral attitudes and relationships that underpin contract. These, as much as self-interest and enterprise, are necessary conditions of the market order. If morality comes to be seen as a form of self-interest, then it is possible that these moral factors may come to be put into the pot of self-interested calculation; and this would be disastrous for the market itself. If the culture of society comes to be dominated by self-interested conceptions of morality, and business relationships turn into a wholly buccaneering, enterprising sort, then there is at least some danger - if there is no other countervailing set of moral values not based upon self-interest - that the moral assumptions on which the market exchange rests could, in fact, be eroded by a culture of self-interest.

This is an issue which goes back a long way in western history. Some sophists in ancient Greece argued that morality is a matter of self-interest, and that it would be foolish to attempt to act justly if one could get away with acting unjustly when it was in one’s interests to do so. Many thinkers on both the left and the right of the political spectrum have argued that the capitalist system emerged from within western European Christianity, which protected moral values from the adverse effects of self-interest. However, with the growth of secularisation, which is closely related to the growth of the capitalist economy, these Christian values of trust, truth-telling and promise-keeping have been eroded, turning our understanding of morality into one of self-interest. In these circumstances, the moral framework of values - on which capitalism has historically drawn to preserve the values that are essential to its own effective conduct - has become eroded by the very development of capitalism itself.

No doubt the maintenance of these values could be turned into a formal legal matter, so that there could be legal sanctions against a failure to keep to these moral assumptions. However, there are three difficulties with this assumption that the moral prerequisites of markets could be turned into matters of the rule of law. The first is that the rule of law itself cannot operate very effectively where there is a collapse of the moral assumptions that the law is there to protect. The law does not exist in a moral vacuum. It has to be underpinned by widely accepted and diffused moral values. However, if these are turned into matters of self-interest, then the authority of law that seeks to preserve values that have a different basis might be undermined. This has become clear recently in the context of the regulation of financial markets. Some defenders of the market have been uneasy about some of these forms of regulation, because they see them as embodying the idea of victimless crime, in which someone can be guilty of an offence caused by the unrestrained pursuit of self-interest without there being an identifiable victim of this self-interested activity.

What seems to be lacking in such complaints is that the integrity of the market can itself be a victim of self-interest if it is not constrained by regulation of this sort. This case now seems to be so obvious as hardly to merit argument but nevertheless the argument that regulation is directed to preventing victimless crime is still a central theme of libertarian defences of the market order. However, if the idea of these being victimless crimes were taken as a reason for easing such regulation, then the point I made earlier would become salient: that is, that the law in this area falls victim to the power of a self-interested view of the nature of morality, in which the maintenance of the integrity of the market itself, as opposed to protecting identifiable victims, is not seen as an important issue. The law can maintain this kind of function only if it is assumed that there is a general morality relating to the market, which has to be preserved. If, however, there is a sufficient change of attitude, so that all that counts is whether someone else’s self-interest - the identifiable victim’s - has been harmed, then it is difficult to obtain much social consent for having laws that protect some idea of the general moral integrity of the market. Finally there is the problem that regulation rather than internalised constraints on behaviour may well create moral hazard if we think that moral values are just another name for self interest. No set of rules can guard against all eventualities and a purely self interested person interested only in maximising his or her utilities might well seek to circumvent rules which paradoxically might turn out to be easier when they are set out.

In order to secure such consent to rules whose function is to protect the integrity of the market as a whole, there has to some wider appreciation of the need for the moral integrity of the market. Of course, it might be argued that this could still make sense in terms of the long-term interest of those involved in market transactions or, alternatively, appealing to some kind of idea of ‘universalisability’: what would be the consequences for the market if everyone behaved liked that? However, both of these strategies based upon self-interest still presuppose that there is some constraint on self-interest in market transactions, either of a long-term sort, or of a ‘universalisable’ sort. The potential problem is, though, that the prospects of short-term gains might well override such constraints unless there is some deeper-seated morality in society: what Hegel called Sittlichkeit, or ‘ethical life’ or ‘civic virtue’, which acts as a countervailing power to self-interest.

Finally a further problem involved in turning these ethical matters into formal ones of legal sanction is that it is more costly and inefficient. If there are internalised values of a non-self-interested kind, which constrain behaviour in the market, then it is at least arguable that this is a less costly form of regulation than what would otherwise be a growing problem, requiring more and more regulation.

The second aspect of the moral underpinning of the market is in many ways parallel to the first, and was well-recognised by Adam Smith: that is, the maintenance of some sense of civic virtue and social obligation in relation to the market. On a purely self-interested view of the morality of the market, attitudes could arise in relation to economic behaviour that actually damage the market.

This could occur in two ways. First, on a self-interest view there would be every incentive for a trader to seek to secure a monopoly in the goods and services that he or she has to sell. Monopolies, again, are harmful to the free market, and also in some cases (such as newspapers and the media) harmful to society as a whole. But what argument could be put to a trader that he or she should not try to secure a monopoly if it is in his or her interests to do so? Again, the only appeal would be to some sense of the integrity of the market as a whole, or to a principle of universalisability, or to Adam Smith’s own ‘impartial spectator’ theory: ‘What if everyone behaved in that way?’

Again, however, this means that there has to some constraint on self-interest, and this sense of constraint has to be there to support legal sanctions against monopoly. Without some sense of civic virtue, or orientation to values that are not of a self-regarding kind, market behaviour will require growing regulation in the interests of the market itself. Such regulation, in turn, may become increasingly problematic if there is not some more general concern to cultivate a sense of social and civic responsibility, which, as I have suggested, may become more and more difficult with the erosion of social values in favour of private and self-interested ones.

The second way in which this occurs is similar to the first: that is, from the point of view of self-interest, the individual trader may, in a wholly rational way, be a rent-seeker from government - seeking, that is, to secure privileges from government in terms of subsidies, tariffs or legal privileges. On a free market view these are, again, harmful to the market, and the government has to resist them. However, the same problem occurs again. The state has to act to resist this in terms of the integrity of the market, and in terms of a sense of fairness and justice in the society as a whole. In order to do so, it has to be able to appeal to a sense of civic virtue and consciousness, which goes beyond self-interest. Yet the growing role of market relations in society may erode society’s capacity to take the steps necessary to protect the forms of virtue on which the market rests.

In this sense, therefore, I want to argue that the market certainly requires a sense of enterprise and self-interest, but it equally requires a sense of civic virtue without which the market itself cannot function effectively. The difficulty is that the growth of market relationships may gradually displace those forms of civic virtue and responsibility which, if they were internalised, could constrain individual behaviour in the interest of the market in an informal way; and may, in the longer term, erode the social basis of consent necessary for formal legal regulation when informal mechanisms have failed.

The sphere of the market

I now want to turn to a different set of moral boundaries, which might be encapsulated in the idea that the market does have a clear sphere, but that equally there are spheres in which market relationships are inappropriate and that the market may damage its legitimacy in its own sphere if it transgresses those boundaries.

The idea behind this is drawn from Michael Walzer’s Spheres of Justice (1983), in which he argues that goods and services in society have a social meaning and identity that are closely related to the culture of the society, and that must play a central part in deciding how these goods are to be distributed in that society: for example, whether they are to be distributed by markets, the state, of various kinds of voluntary associations.

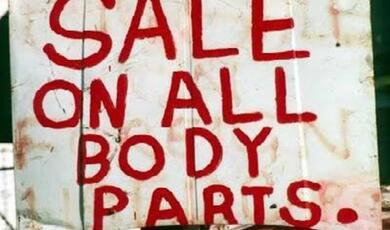

I shall take two examples, which clearly imply some kind of dispute about the moral boundaries of the market. These boundaries are not fixed in some kind of theoretical or a priori way, but have to be seen to be closely woven into the culture of a particular society - in this case, the United Kingdom. The first example is whether the sale of human organs should be permitted: that is, whether there should be a market in bodily parts. On a strictly capitalist view of market principles, it is very difficult to see why there should not be such a market. The scope for a market is clearly quite wide. There could be a market in blood and blood-products; in kidneys; in sperm; in renting out a uterus for surrogate pregnancy; and so forth.

On a market view, at least three principles would favour a market in these areas. The first is that there is a clear demand for these organs among people who might be in quite desperate need of them. Secondly, the donor system that currently operates my lead to a shortfall in supply, as has certainly happened in the case of kidneys. Finally, if markets are usually construed as exchanges in property rights, then if a person owns anything, he or she owns the parts of his or her body. Indeed, most capitalist theories of property rights - from John Locke to Robert Nozick (1974) - follow from the idea of self-ownership.

The case for a market in organs and tissues has been put forcefully by advocates of the free market. The Institute of Economic Affairs has long argued for a free market in blood products, to run alongside the donor system; Woodrow Wyatt argued the case in The Times September 1989, when the issue of the sale of kidneys for the transplant operation in the London Humana hospital was in the news; and Simon Rottenberg (1982), the free market economist, published a chapter called ‘The production and exchange of used body parts’ in the Festschrift for Ludwig von Mises. All of these would see a clear role for markets, and for enterprise and entrepreneurship, in these fields. However, within our society, such advocacy has fallen on stony ground, and I think that most people would feel that some kind of moral boundary had been crossed by the market and the enterprise culture if they could be extended into such fields.

In his well-known book on the blood donor system in Britain, The Gift Relationship (1970), Richard Titmuss argued that if blood could be bought and sold, then anything could be. If human tissue is a marketable commodity, then there are really no social limits to ‘commodification’ and the scope for the enterprise culture. To its credit the government, despite its free market predilections, has set its face against a market in such contexts. This seems to be a clear case, to use Walzer’s terminology, in which the market would be crossing into an inappropriate sphere. This is not, as I have said, based on a priori reasoning, but rather on the social understanding that we, as a society, have of such goods. It might, therefore, be crucial to the idea of legitimacy of the market itself that it does not try to cross such boundaries.

We might, of course, want to see whether this social understanding is based upon some clear principle, and this might be important in trying to determine a general limit to the kinds of goods that are subject to commodification. One possibility for a general principle might be an underlying attachment to the idea of respect for persons: that people should not be treat themselves as commodities, or as means to the ends of others. This was certainly the basis of Kant’s objection, when he discussed this issue in the eighteenth century in relation to the sale of teeth, hair and sexuality through the recruitment of castrati for Vatican choirs - although the point could be extended to prostitution as well. There are complex issues here which would also have a bearing on matters such as pornography and the general ‘commodification’ of the body; and also on the general issue of a market in health care, which makes money-plus-need the criterion of receiving care, rather than just need alone.

It may be that we do not have a consistent view of the moral boundary here. However, for present purposes, all that needs to be said is that the rejection of the sale of tissues and organs implies that there is a deep-seated moral boundary to at least some forms of bodily ‘commidification’ in Britain, and that this sets a clear boundary both to markets and to the enterprise culture. It may well be in the interests of the market that this boundary be maintained, for, as I have argued earlier, the market itself has to operate within a framework of moral principle if it is to be legitimate.

The second example of a similar sort is a complex one with many ramifications, which I cannot discuss in detail, but it is concerned with the way in which the extension of the market can displace the service ethic in society. In the view of many free-marketeers, the service ethic in the public sector in spheres such as health care, social work and education is something of a myth. The ‘public choice’ school of economists argues that those who work in welfare and educational bureaucracies in the public sector are, in fact, motivated in the same way as people in markets. The fact that someone earns his or her living as a doctor, nurse, social worker or teacher does not mean that they have stepped into some new moral realm in which they are motivated by the ethical demands of caring, service and vocation, unlike people in markets who seek to maximise their utilities. They do, in fact, seek to maximise their utilities by using their role in the public sector to increase their responsibilities, the scope of their bureaucracy, their status and their income; and they do this free from the threat of bankruptcy, and in ways that make it difficult for elected representatives to constrain their behaviour because of their professional knowledge and expense.

Given this diagnosis, there is a case for either privatising public services and subjecting them to market constraints, or invoking market principles within the public sector by mechanisms such as internal markets - or, if these solutions are not available, for tying providers down by performance indicators and greater specification through contracts and the like, to more definite and less discretionary forms of delivery. If people are motivated by utility maximisation rather than the service ethic, then, the argument runs, they have to be constrained by market or quasi-market mechanisms. The caring professions should be demythologised into producer interest-groups, and their behaviour constrained in the same way as behaviour in the market is constrained by the customer.

This argument has many important aspects that cannot be elaborated on today. However, I do want to question one basic assumption, which seems to be involved in this analysis, which implies that the service ethic can be a feature only of voluntary organisations, in which people are not paid and therefore have no incentive to turn themselves into producer interest-groups as maintained by the ‘public choice’ model. This analysis assumption turns on accepting the argument that utility maximisation is the basic form of human behaviour, or at least of behaviour for which one is paid. This assumption is, in itself, highly disputable; and I have suggested earlier that if it is accepted then some assumptions about civic virtue, which may be absolutely necessary to the market itself, are put into jeopardy.

It can also lead to some changes in behaviour among those in the public sector, which might, paradoxically, harm the service offered to the client, patient or customer, for if the service ethic is displaced by a contractual or a market one, there is a danger that people whose self-understanding is that they are offering a service, but are being constrained to behave as if they were in a market or a quasi-market, might then act only within the terms of the contract. This has, I think, already happened in schools. In my experience, there is a strong feeling among teachers that, if they are being put into this kind of position, then they will do what their contract specifies but nothing else. It would not then be open to government to appeal to an ethic of service to provide more than is specified in the contract, since the whole point has been to displace the ethic of service and replace it by contract or quasi-market relations.

Again, a market-oriented approach may lead to effects that are unintended. Can we in fact manage a society in which the ethic of service is displaced to the voluntary sector? Just as in the market, where appeal is made to virtues which may not be subsumable under those of private utility and private interests, so, too, in the state sector the introduction of markets, quasi-markets and the dominance of contract might well deprive us of ethical principles such as service and vocation, which are essential to the efficient delivery of services. We have to be very careful about the market again crossing an important moral barrier and replacing one ethic by another.

There is another deep issue here. In the public sector, which is part of government and should therefore be subject to the rule of law, we are concerned with things such as equity and treating like cases in like manner. These are not values served by markets, and there is no particular reason why they should be. However, they are central to government and to the rule of law. There is a clear danger that the introduction of market principles into the public sector might undermine these basic principles of public provision and, again, this provides some basic idea of moral restraint on what the role of the market might be in this context.

Moral consequences

The final sort of limit to markets that I want to discuss is in terms of outcomes. To what extent are the outcomes of economic exchange to be accepted as morally legitimate as they stand, whatever the degree of inequality to which they give rise? Here, the free market position has three main arguments at its disposal to support the claim that the outcomes of markets are not subject to a moral critique that could entail redistribution in the interests of social justice. The first is that market outcomes are the consequence of individual acts of free exchange. If each individual transaction is uncoerced , then the outcome is procedurally just, being the aggregate result of individual acts of free exchange. Given that its consequences are arrived at freely, there is no case for criticising the market. Adherence to a just procedure, the market, cannot yield unjust results.

The second argument is that injustice can only be caused by intentional action. We do not attribute injustice to the results of unintended processes. However, a market is an unintended process in the appropriate sense. In a market, millions of people buy and sell whatever they have to exchange, and no doubt this individual buying and selling in undertaken intentionally. The ‘distribution’ of income and wealth arising from all these individual intentional acts is not itself intended by anyone. Since the distribution of income is not intended, it is by the same token not unjust, whatever its degree of inequality.

The third arguments is that, even if there were a moral case for criticising the market in the interests of distributive justice, we have no agreed criteria of distributive justice. We live in such a morally diverse and fragmented society that there is not the degree of social consensus to call upon to ground a set of principles of distribution. There are many possible distributive criteria: need, desert, entitlement, the contribution of labour, and so forth. All of these are, to some degree or another, principles of distribution; they are mutually incompatible and we have no resources in terms of social morality to underpin one set of principles compared with another.

Overall, taking these arguments together, market outcomes have to be accepted as being, in principle, unprincipled. In this situation, in which the privatisation of morality has gone so far, all we can do is trust the outcome of the market. The market, in effect, embodies subjective wants and preferences, and one’s value is not to be fixed by political means according to disputed principles of justice, but rather by the subjective preferences and valuations of one’s goods and services in the market.

This is a formidable and comprehensive critique of end state principles, such as social justice, which have usually been seen by social democrats, social liberals and democratic socialists as central to restraints on the capitalist market. The critique is so wide-ranging that I cannot deal with it fully here. However, I will make some skeletal points about each of the three arguments, which might then leave a foothold to develop a critique of market outcomes in these terms.

The argument that market outcomes are the result of individual acts of free exchange depends upon a number of rather large assumptions. The first is to do with property rights. Essentially, a market is about the exchange of property rights: the good that I own I sell in the market for the good that you own. If this exchange is to be legitimate, then property titles must be held to be legitimate. To impose a regime of market exchange on wider and wider areas of society on the basis of radical inequality of ownership takes it for granted that the property titles that have led through time to existing inequalities are, in fact, just.

It has often been noted that, although private property ownership lies at the basis of capitalist theories of market exchange, there has really been no widely accepted theory of private ownership, and certainly some of those that have been presented, such as Locke’s, Nozick’s and Hegel’s, have very grave difficulties. Often, as in the work of Hayek (1960), the assumption is made that markets can be legitimately imposed on wide inequalities in property because: (a) we have no agreed criteria of distributive justice in terms of which property could be redistributed, and (b) property is probably in the hands of those where it can do the most productive good. The worst-off members of society will be helped by the trickle-down effect of the market more than they will be by redistribution, and if those who hold property hang onto it, then it is likely that this will create more economic dynamism to trickle down to the rest of society.

However, each of these arguments is highly contestable. The first argument assumes the truth of what I have been questioning. We cannot really argue that there cannot be a moral case for looking at property ownership, because any moral case will be so contested. This is the issue to which an answer is needed, not a reassertion of the argument. The second argument assumes that validity of the trickle-down effect. This is a matter shrouded in empirical controversy and depends a good deal on our understanding of poverty. However, there is a moral and conceptual argument raised by the assertion that the poor will be made better off by the market operating against a background of existing inequality, rather than any other alternative. Often this point is put in terms of a claim that the market empowers the poor more than political allocations of resources based upon an appeal to social justice. However, this is at the best dubious if we take the idea of power seriously.

Certainly, in the sense of ‘power over’, power is a positional good. That is to say, it is a good the value of which depends on some people not consuming it. The clear characteristic of a positional good is that, if it is equally distributed, its value disappears altogether. This seems to be the case with power in the sense I have defined it. If that is so, then power and empowerment cannot be subject to the trickle-down effect, just because positional goods cannot trickle down without disappearing. In order to empower the powerless, it is necessary to remove some of the power from the powerful. This cannot be done by creating more power to trickle down to the rest of society. The point at stake here is that inequality matters in terms of empowerment and it is far too bland an assumption to make that, if markets are imposed against radical social inequality, somehow the poor will be empowered. This cannot be the case if power is a positional good.

The second set of arguments, dealt with the unintended nature of market outcomes and, therefore, the irrelevance of social justice. Let us accept for the sake of argument that market outcomes are unintended. We can then ask the question whether the unintended nature of an outcome makes any difference to whether that outcome can be the subject of a critique in terms of social justice. If outcomes are foreseeable for groups of people, then I believe that social justice still has a place: at the level of personal morality it is possible to argue that we bear responsibility for the unintended but foreseeable nature of our actions. If market outcomes are foreseeable for groups of people, such as that those who enter the market with least are likely to leave it with least, then by parity of reasoning we could argue that we bear responsibility for the outcomes of processes that, although they may be unintended, are at least foreseeable. This responsibility is then in terms of social justice for the distributive consequences of foreseeable processes.

The free market theorist can hardly deny that market outcomes are foreseeable, because if it were not so there would be no basis to argue for the extension of markets. For example, the argument in favour of the deregulation of rent rest upon the assumption that it can be foreseen that this will increase the supply of private accommodation available for rent. The foreseeable consequences of markets lie at the heart of the case for markets and also lie at the heart of the possibility of a critique of their outcomes and of asserting our collective moral responsibility for them.

The final argument, that we do not have a public morality to underpin distributive justice, is a powerful one and takes us back really to the points I made in the section about the moral underpinning of markets. The assumption in that context was that the privatisation of morality has gone so far, and the reduction of morality to self-interest has become so entrenched, that it is impossible for us to have a public or civic culture that would allow distributive justice to work in that context. I have already suggested that civic virtue is actually central to markets and their legitimacy, and I believe that moral pluralism can be overdone and in ways that would not only make social justice problematic, but also the moral assumptions on which markets rest.

All I can say here on this very big topic is that I believe that there are basic needs or, following Rawls (1973), primary goods that we have in common as members of a society such as ours, in the sense that these are goods that we need to achieve other sorts of goods. Among these are income, food, shelter, education, health care, and health education, together with the capacity to live a relatively free and autonomous life. These goods cannot be secured to individuals as of right, never mind with some degree of fairness or equality, by the market; and there is a role for an appeal to distributive justice in terms of these necessary conditions of human fulfilment. This is quite different from the assumption that all human goods should be distributed according to fixed criteria of social justice, a point that I made when discussing Waltzer.

Overall, then, however important enterprise and the market are, there is still a good case for keeping them in their place. The 1970s saw nemesis succeed hubris in the context of the power of the state. If we are not sufficiently pluralistic in our thinking and if we mindlessly extend markets into inappropriate spheres, it may be that the future might see market overload in a way we experienced in previous decades. The authority of government can be increased by limiting its scope; the legitimacy of markets may yet depend on keeping them in their proper place.

A version of this lecture was published in Values of the Enterprise Culture ed. P Heelas, P. Morris. Macmillan 1992. This book was based on a very enlightening seminar at the University of Lancaster.

References

Hayek, F. 1960. The Constitution of Liberty. London: Routledge & Kegan Paul

Nozick, R. 1974. Anarchy, State and Utopia. Oxford: Blackwell.

Rawls, J. 1973. A Theory of Justice. Oxford: Oxford University Press.

Rottenberg, S. 1982. Production and exchange of used body parts, in I. M. Kirzner (ed.). Method, Process and Austrian Economics. Essay 5 in Honour of Ludwig van Mises. Lexington: D. C. Heath

Titmuss, R. 1970. The Gift Relationship: from Human Blood to Social Policy. London: Allen & Unwin.

Walzer, M. 1983. Spheres of Justice. Oxford: Martin Robinson.

© Professor The Lord Plant 2012

This event was on Tue, 09 Oct 2012

Support Gresham

Gresham College has offered an outstanding education to the public free of charge for over 400 years. Today, Gresham plays an important role in fostering a love of learning and a greater understanding of ourselves and the world around us. Your donation will help to widen our reach and to broaden our audience, allowing more people to benefit from a high-quality education from some of the brightest minds.

Login

Login