Stealing the silver: How we take from the dispossessed, the poor and our own children

Share

- Details

- Transcript

- Audio

- Downloads

- Extra Reading

There are numerous cases where well-meaning people find themselves defending amoral, or perhaps even immoral, economics. Regressive taxes, the BBC licence fee, pollution, the Common Agricultural Policy, postcode lotteries and pensions appropriations are all examples where wealth or risk are transferred among segments of the population, or among generations, with social and ethical consequences. What lessons, if any, can help us to understand what we're doing, and do it better?

Download Transcript

STEALING THE SILVER -

HOW WE TAKE FROM THE DISPOSSESSED, THE POOR AND OUR OWN CHILDREN

Professor Michael Mainelli

Good evening Ladies and Gentlemen. I'm pleased to find so many of you interested in stealing from your children that you left them at home this evening, yet I hope to share some thoughts with you tonight on the discount rate that may leave you wondering which generation is winning.

[SLIDE: OUTLINE]

As you know, it wouldn't be a Commerce lecture without a commercial. So I'm glad to announce that the next Commerce lecture will continue our theme of better choice next month. That talk is 'Fads And Fashions: If They Are So Bad, Why Are They So Rapidly Rich?', here at Barnard's Inn Hall at 18:00 on 17 December.

An aside to Securities and Investment Institute, Association of Chartered Certified Accountants and other Continuing Professional Development attendees, please be sure to see Geoff or Dawn at the end of the lecture to record your CPD points or obtain a Certificate of Attendance from Gresham College.

Well, as we say in Commerce - 'To Business'.

There are numerous cases where well-meaning people find themselves defending amoral, or perhaps even immoral, economics. Regressive taxes, the BBC licence fee, pollution, the Common Agricultural Policy, post code lotteries and pensions appropriations are all examples where wealth or risk are transferred among segments of the population, or among generations, with social and ethical consequences. What lessons, if any, can help us to understand what we're doing, and do it better (sic)?

Stealing the Sliver

[SLIDE: STEALING THE SLIVER]

Tonight's talk is entitled 'stealing the silver'. There are two ways to 'steal the silver', bottom-up or top-down. The modern association of this phrase is with servants or guests taking the silver cutlery from the master and mistress of a house. This is bottom-up 'stealing the silver'. Thus, the idea is that those in positions of less power can sometimes advance themselves materially, if not morally, through theft. However, the phrase is older.

In fact the phrase 'stealing the silver' has Gresham's Law overtones, 'bad money drives out good if they exchange for the same price' [Mundell, 1998]. During the reign of Lucius Domitius Aurelianus (Aurelian, 214 to 275 AD), Felicissimus, mintmaster at Rome, revolted against the emperor. The revolt seems to have been caused by Aurelian attempting to stamp out Felicissimus' and the mint workers' practice of stealing the silver used for coinage by producing coins of inferior quality. The revolt was suppressed with perhaps 7,000 casualties. Many revolting mint workers and some rebellious senators were executed.

Felicissimus' theft of silver was top-down. He, and the mint workers, abused the economic system for their own gain. Thus, the idea is that those in positions of power can advance themselves materially through systematic theft, if they don't get caught. Tonight, we're going to examine some of this systematic theft with the hope that understanding these systematic approaches may help you be vigilant against top-down theft for the protection of the dispossessed, the poor and your own children.

Creaky Victoriana

[SLIDE: CREAKY VICTORIANA]

In order to examine top-down theft more closely, we need to move closer to the present. Let's move to the Victorian era and paraphrase the 'Life of Brian' (1979) film joke, 'what have the Victorians ever done for us?' All around us in the UK, we find ourselves relying on Victorian infrastructure for water, sewage, roads, ports and railways. In London, more than half of the water mains are more than 100 years old, and around a third are over 150 years old. So what's been going on the past 100 years? In fact, Thames Water, the London water company, even implies that the Victorians are at fault - 'London's Victorian water works need to be modernised'.

I was an incidental party to the discovery of a major, working yet unknown Victorian sewage tunnel in the City of London a few years ago. The tunnel was clearly quite significant to the sewage system but we had taken it for granted over a century and half of ignorance. We rely on the Victorians quite a bit, and don't even know how all of it works. Water supplies may seem boring, but don't forget that sewage and clean water are all that separate us from cholera or typhoid. Sometimes, we might as well be living in a science fiction novel's world of effete descendants completely dependent on the technology of a previous era's that they can't understand and consider to be magical - as the science fiction author Arthur C Clarke famously remarked - 'Any sufficiently advanced technology is indistinguishable from magic.'

Because of our ignorance of Victorian efforts, the water privatisations of the late 1980's were problematic. Years and years of repairs under the intervening public sector system, where the asset values were irrelevant, had led to decades and decades of not bothering to record asset changes. This led to situations where contemporary observers were unable to find the assets, such as an added sewage duct, or to discover that things don't flow where you think. In one case I remember, we could only find 40% of the pumping, valves and piping during a random sample of the asset base for one water company. So what was being privatised? Quite a few customers and a lot of hope that the Victorians built things properly in the first place.

Victorian engineering and a conversation with Jan-Peter Onstwedder over our engineering studies made me recall that one of the hardest things to avoid is over-engineering. Over-engineering is when something is designed to last longer or in worse circumstances than is needed. In other lectures, we will explore robustness and resilience, but if you think about planned obsolescence from an engineering perspective, the ideal situation is when everything fails at once, or at least around the same time. If one thinks about an automobile, one would like the engine, social acceptance of the interior, the periodic cycle of the tyre replacements and everything else to collapse at a specific time. Nothing is wasted. The car fails when everything coincides with its own obsolescence. The ultimate engineer would plan that everything collapsed at some specific point on the odometer, say 150,000 miles. In the ideal situation, the fuel tank would be empty and the car would coast into the scrapyard.

'Making do' while the systems fail can lead to complicated systems interactions. After several decades of neglect and poor maintenance, to some degree due to lack of water pricing and non-recognition of the value of the assets on their books, leading to false profits, leakages from UK water systems are high. Historically, water pressure was anywhere from 3 to 4 bar, i.e. enough to raise water another 30 to 40 metres from where it leaves a water company's pipes (3 bar is a good shower pressure). The pressure levels may not have been statutory, but they were relied upon. By comparison, in Utah for instance, the statutory requirement is around 2.0 bar. Now, in order to reduce water leakages, UK water companies are reducing water pressure. It is to be hoped that at some point their maintenance programmes allow them to restore traditional pressure, but in the meantime thousands of homeowners are installing water pressure pumps consuming electricity locally to get the system pressure back to normal for showers and other machinery. Of course, if water companies do restore traditional pressures, then we might expect to see quite a few leakages in homes which, during the intervening period, haven't installed systems robust enough to handle higher pressures.

[SLIDE: INTERGENERATIONAL TRANSFER]

Let's return to the Victorians. If everything lasted too long, were they engineering idiots? I might argue that we (1) lied to ourselves, and (2) stole from the Victorians. We lied to ourselves over the years because we failed to invest in replacing things at an appropriate rate and accepted slightly deteriorating standards, while failing to accrue for future major overhauls. And the Victorians, in the reverse of tonight's talk, stole from themselves to bequeath us an over-engineered infrastructure, not just in water and sewage, but also in roads, railways, public buildings and many other facilities.

Engineering and infrastructure cycles tend not to coincide with political cycles, despite all the talk of prudence over the economic cycle. Matthew Parris, writing in the Times on 8 November, brought to my attention an open letter of 4 July 2004 from the outgoing rail regulator, Mr Tom Winsor, to his successor. This letter highlights the tension between long-term projects and politics. Mr Winsor notes:

'...Politicians will talk about decades of underinvestment and putting right the mistakes of the past, but in general - and with some honourable exceptions - they are simply not programmed to make decisions which put the long-term interests of the industry and the public ahead of the short-term political imperatives of the moment. If the fire-alarm is ringing, the tendency is often to break the bell and stop the noise; not to put out the fire.'

The Victorians over-engineered, intervening politicians took credit for cost savings that were really under-maintenance and everybody tried to hand the problem on to the next generation if at all feasible. So yes, in a sense, we stole from the Victorians, but our parents stole from them and from us, while we try to steal from our own children. Unfortunately in the hot potato/musical chairs nature of long-term infrastructure, we happen to be the ones left with creaking Victorian water infrastructure at, assuming we don't do a botched job, the time it needs replacement. Our utilities may wish to blame their forebears; I put the blame closer to the modern era. Successive generations failed to make adequate provisions for maintenance and replacement. The long-term investment cycle does not resonate well with the shorter-term political cycle.

But how should we make decisions about long-term investments? Economic and financial theory claims to have an answer, compare long-term investments with short-term decisions using the concept of net-present-value (NPV). We shall return later to look at the 'seven subtle steals', but this is a good time to refresh our thoughts about investment decisions.

Investing For The Future

You certainly know what an interest rate is, e.g. the percentage applied to your deposit every year in a simple deposit account. The underlying assumption is that cash today is worth more than the same amount of cash tomorrow. We need to be paid for saving or investing today, which is equivalent to deferring gratification till tomorrow. The 'discount rate' is a financial concept based on the future cash flow in lieu of the present value of the cash flow. The discount rate gives you an idea of the present value of future cash. So the interest rate and the discount rate are linked. If a bank offers you an interest rate of 25% and you place £8 in the account, you expect to retrieve £10 next year. If a bank offers you £10 next year for £8 today, the discount rate is 20%, i.e. the interest rate that brings the value back to today's terms. So if anyone offers you something worth more than £10 a year from now, that is a better deal for you. Interest rates go forward to the future; discount rates come back to the present.

[SLIDE: SIMPLE NPV]

In business, decision-makers constantly decide whether to invest in one or more projects. The basic idea is simple, will the investment produce more cash than it consumes? Business people use discount rate calculations all the time to illuminate decisions such as:

¨ Can the company afford an investment, with debt, without?

¨ When will an investment yield returns that exceed its cost-of-capital?

¨ What are the expected profits compared with returns available elsewhere?

Let's take a simple example of three options for a businessperson with £100 and ten years of time, Keep-the-Cash, Micro-Project and Mega-Project. Keep-the-Cash, says don't spend the £100. Micro-Project requires £100 and Mega-Project requires £400. However, the businessperson believes that they will make a 25% return per annum on the Micro-Project and Mega-Project expenditures. As you can see from this example, the most money is made with Mega-Project, £400 more, the second-most with Micro-Project, £25 more, and nothing with Keep-the-Cash, leaving the businessperson with £500, £125 and £100 respectively. If this is simple NPV, what is complex?

[SLIDE: SIMPLE NPV WITH CASH INTEREST]

There are two immediate problems here. The first is that the businessperson wouldn't just sit on the cash. At the very least he or she would put it on deposit with a bank. This slide shows that with an interest rate of 5% on the cash, taking the Keep-the-Cash option results in £155. Micro-Project is now £30 less attractive than Keep-the-Cash. The businessperson is better to keep the cash in the bank than to invest in Micro-Project.

[SLIDE: SIMPLE NPV WITH INTEREST ON CASH AND LOAN]

So let's turn to investing in Mega-Project. The second problem is that the businessperson doesn't have £400 for Mega-Project and will have to borrow £300. The lender of the £300 will require a return on the money. If the money must be repaid in equal installments over 10 years at 10%, then Mega-Project actually loses £65 of the base £100, Micro-Project returns £25 and just putting the cash on deposit, Keep-the-Money, returns £55.

Tonight's lecture is meant to be about Commerce, not Geometry. But the mathematics are crucial. Compound interest is fascinating. Einstein supposedly said that compound interest was 'the greatest mathematical discovery of all time'. Of course that implies that 'compound debt' was the worst mathematical discovery of all time.

[SLIDE: GEOMETRY OVER COMMERCE]

Net-present-value (NPV) is a common method used in business to make capital investment decisions. Basically, all future costs and cashflows are expressed in terms of the value of money today. There are a number of concepts related to NPV, for instance the common term 'discounted cash flows'. Many analysts value the shares of a company based on discounted cash flows. They take the future expected cash flows of the company and discount these cash flows back to a net present value. Analysts discount the cash flows using a discount rate typically based around the cost-of-capital or the interest rate one might get on deposit or a government bond. Thus the value of a company is the net present value of all the future cash less the cost of the shares.

NPV is very sensitive to the interest rate for borrowing and the interest rate for lending. Most projects require investment, so we have the concept of negative cash flows, and that allows us to produce a simple equation.

Mathematically for a multi-year project, we say that CF(x) = cash-flow in year x, d = discount rate, and n = the number of years in the project:

NPV = CF(0) + CF(1)/(1+i) + CF(2)/(1+i)2 + ... + CF(n)/(1+i)n

Note that CF(0) would typically be negative for most investment projects.

To move from Geometry back to Commerce, I need to show you three more graphs to complete the picture.

[SLIDE: GARGA-PROJECT INCOME]

So let's look at something similar to Mega-Project. This is Garga-Project where we spend 1% of the world's $48 trillion GDP [2006 figure according to the World Bank], i.e. $480 billion, on something useful. Garga-Project is so useful that it will produce $48 billion of value in nominal terms forever. We expect Garga-Project to produce a 10% return in the very next year, i.e. $48 billion of value. But given a 10% discount rate that $48 billion is worth a bit less next year, about $44 billion in today's money.

[SLIDE: GARGA-PROJECT PAYOFF]

We can subtract that $44 billion return from the $480 billion cost and move to the next year. The following year we get another, $48 billion, but that's only worth $39 billion in today's money. The cumulative cash line here shows the situation for the first 25 years. The project hasn't yet broke even. In fact, despite a 10% return, Garga-Project doesn't even break even over 50 years later; it takes 60 years.

[SLIDE: DIS-COUNTING INVESTMENT]

To illustrate the sensitivity to the discount rate, I set out here a number of discount rates from 2% to 14% for Garga-Project. You can see that with discount rates for Garga-Project above 10%, Garga-Project never moves into positive numbers, i.e. pays off. Discount rates below 10% take varying degrees of time to pay off. Rather obviously, if Garga-Project produced higher returns, then the discount rates would matter less and the pay off dates would be sooner.

What have we learned so far? Ideal projects have high returns, but you already knew that. When the discount rate goes up, present values go down. When the discount rate goes down, present values go up. You will have noticed that if you apply a lower discount rate then long-term projects look better. You'll be relieved to know that I don't intend to go through any more calculations, so long as you understand that this seemingly technical discount rate is fundamental to evaluating long-term investments.

At Any Rate?

In business, the correct discount rate is not necessarily obvious and can be the cause of heated discussion. Typically, for business projects business people calculate a 'cost-of-capital' to arrive at a discount rate. Cost-of-capital can be a fairly complex calculation that employs the Capital Asset Pricing Model, which in turn depends on factors such as the risk-free rate of return, the equity rate, the bond-rate, and the debt/equity structure of the organization. We have ignored how business people attempt to take account of inflation. Further, we have ignored taxation. Some taxation systems favour expenditure over capital investment, or vice versa. Some taxation systems favour debt over equity, or vice versa. Somewhat ironically, despite all these machinations, the discount rate used by most business people seems to circle around 8% to 10%.

More crucially, we have ignored risk, whether the projects achieve their objectives at the cost stated when the decision is made, or achieve their objectives at all. Micro, Mega and Garga Projects might overrun and need more money. Even with more money, Micro, Mega and Garga Projects might only partially succeed. Micro, Mega and Garga Projects could fail and be a complete waste of money. There are more advanced techniques for investment appraisal used by the cognoscenti, such as real option theory, portfolio analysis, and many more, but you'll pleased to hear I intend to ignore them too.

But discounting future consumption can lead to conundra (a conundrum of a plural), particularly over finite resources. Global fishing is a $55 billion industry, possibly on its way to extinction. Taken to the extreme, eating a $6 fish tonight can be calculated as worth more than consuming all the fish in the world a couple of millennia from now at a discount rate of 1%. At a discount rate of 10%, tonight's $6 is worth all the world's commercial fish stocks 260 years from now.

We shall return to some of the complexities of discount rates when we close, but it might help to return to how we steal from the dispossessed, the poor and our own children. We don't want to be seen to be outright thieves, so we have a habit of mucking around with the discount rate, i.e. claiming that future expenditure is worth less than today's. There are three common reasons for discounting future consumption:

¨ consumption levels will be higher in the future, so the marginal utility of additional consumption will be lower;

¨ future consumption levels are uncertain;

¨ future consumption should be discounted simply because it takes place in the future and people generally prefer the present to the future.

One of the biggest issues in economics is discount rate to use under various circumstances. Businesses have to use something close to their cost of capital, but governments have more leeway. In 2002 HM Treasury stated that, 'The current discount rate is being 'unbundled' so that the new rate reflects only one factor (the social time preference rate), set at 3.5%. The current rate of 6% implicitly allows for such factors as risk, optimism bias, and the cost of variability. It is now proposed that these are dealt with separately and explicitly.' If you think about it, a pure time discount rate of 3% implies that someone born in 1982 'counts' for roughly twice as much as someone born in 2007 simply because of the difference in their birth dates.

For economic evaluations across society, discount rates are typically lower. When people attempt to estimate intergenerational transfers, they attempt to estimate the 'pure rate of time preference' - the rate people would ethically use to evaluate transfers to future generations. To get there, analysts sample the population using ethical questions about saving lives versus costs to try and find these utility functions, often arriving through a thicket of contradictions, as did HM Treasury, at an estimate around 1.5%. Because people die, and the average annual death rate for adults is about 1.5%, this is not a surprising number. In some ways, there is no such thing as society, only individuals. Society, if it had a mind, might think that it will live forever and try to balance income across everyone in all generations. Individuals, at this point in time, quite rightly want to see payback in their lifetimes. No wonder old people are crotchety about long-term investments. It will be interesting to see if longer lives, perhaps even immortality, decreases the pure rate of time preference.

Having established a pure rate of time preference, we still need to establish a pure time discount rate for investment decisions. The pure time discount rate should be higher than the pure rate of time preference, reflecting the fact that you can't do everything. If we set the pure time discount rate to zero, we find that our offspring are too numerous and infinity is a long time. Very tiny income streams have enormous net present values. Thus we find ourselves having to do everything now for 'infinite generations yet unborn'. HM Treasury's social time preference rate seems reasonable at 3.5%. One way to estimate the pure time discount rate is by examination of global long-term real interest rates, now about 2% for the industrialised nations. But a decade ago, global long-term real interest rates were about 4%. Do we care more about the future now than we did a decade ago? It seems to me that the Victorians, who made things to last for 150 years, clearly applied a very much lower discount rate to their descendants than we do to ours.

Discount rates much above 3% often render major long-term investments unattractive. Despite this governments often take a short-term view of issues, will investment affect re-election? Does today's tax pain (unless they can hide the tax somehow, perhaps off-balance-sheet) help the next election? This implies that they will often use relatively high discount rates, perhaps 20%, when evaluating investment decisions because they want quick returns. Discount rates such as 3%, 5% and 10% are widely used in economics, but there is little consensus on what value is appropriate in any given circumstance. The confusion reminds me of this joke:

A prisoner had just been sentenced for a wicked crime and was returning to his cell. His guard was most curious about the outcome.

Guard: 'What was the sentence?'

Prisoner: 'I could choose life or 100 years.'

Guard: 'So which did you choose?'

Prisoner: 'Well, life, obviously. Statistically speaking that is shorter.'

[SLIDE: REGRESSIVE TAXATION]

Seven Subtle Steals

So let's examine Seven Subtle Steals - regressive taxation, waste, biased social services, subsidies, lack of competition, under-provisioning and externalities - ways we take from others, sometimes without realising it. Let's explore each one briefly.

Regressive taxation - developing an equitable taxation system is not an easy problem. The entire notion of equity is problematic. State subsidy of the BBC is a long-standing debate, but whatever your viewpoint the licence fee is clearly a regressive tax. The fixed BBC licence fee penalises the poor more as a proportion of income. A flat tax rate, i.e. a straight percentage of income or consumption, also seems to penalise the poor more than the rich, in that handing £10 over to the government when you have only £100 seems worse than handing over £100 when you have £1,000. Yet so-called 'progressive' tax rates, where taxation rises with income, seem all too easily likewise become iniquitous. Intriguingly, discount rates matter here. Perhaps the rich can do more with their money to help the economy than the poor? Or should society invest more in the poor to increase their welfare? One conundrum I've always faced in looking at investment to alleviate poverty is that many definitions of poverty define the poor relatively, as below some %, typically, of median income. In the EU, poverty is defined as 60% of the national median disposable income (after social transfers). Thus the only way to eliminate poverty under this definition is to eliminate inequality. As ever, under this definition, Jesus said it first and best, 'For the poor always ye have with you' [John 12:1-8]. What we are often discussing is inequality rather than absolute poverty.

[SLIDE: WASTE]

Waste - a lot of problems originate from our toleration of ongoing waste. Fairly simple improvements, say a 5% compound improvement in public sector costs, add up to significant numbers in a short period of time. The discount rate matters here. If we think that many costs are unavoidable expenditure, we tend not to make investments to reduce future costs. Further, if we believe in 'endogenous growth theory' then we believe that there is probably a better combination of appropriate policy measures to maximise the interaction of innovation, investment, skills, enterprise and competition beneath a form of macroeconomic stability. If we do evaluate future investments and policies, but use discount rates that are too high, then we do not invest enough to make things more efficient in the future.

[SLIDE: BIASED SOCIAL SERVICES]

Biased social services - many of our public services are biased. Public sector investment decisions are made by government economists struggling to balance differing discount rate decisions, and then being overwhelmed by politics. A good example is rail over road, or vice versa. Rail and road both enjoy subsidies, differing safety records, different efficiency records, different investment return records and imply different organisation of our cities and communities. Untangling the confusion in order to evaluate rail versus road is a lifetime's work. Economists are expected to decide on investment in things like safety, only to find their decisions overturned if there is a public reaction, for example to a rail disaster. For the use of services received, some social services favour the middle class over the poor, such as the BBC licence fee or the Identity & Passport Service, while others, such as Jobcentres or Child Support favour the poor. It's a truism that the middle classes tend to get the most out of the public sector. Most services are geared towards middle class lifestyles, and votes, in transportation, education or health. Some social services, such as universal provision of postal services or agricultural subsidies favour the rural over the urban, while other social services, such as cultural centres or public transport (sometimes) can favour the urban over the rural. More confusingly, services that may appear biased towards one group or another help to provide a society that many find beneficial. For example, jobs for poorer people provides a better society that benefits all and can't really be said to be targeted just at the poor. Finally, many social services are implicitly rationed, e.g. health and education. The phrase 'postcode lotteries' pinpoints the idea that with government trying to control overall cost, some people find themselves stuck in areas of poor social services, while others hit the jackpot. Again, we are back to discussions of inequality.

[SLIDE: SUBSIDIES]

Subsidies - grants, tax breaks or trade barriers may not seem like theft, but they clearly transfer wealth and opportunity from one sector of the economy to another. Subsidies in areas such as research & development favour certain sectors over others. Further, long-term subsidies or trade barriers tend to store up trouble for the future, for instance large-layoffs of workers who shouldn't have been encouraged to enter a profession, but then need retraining. Trade barriers are often erected to provide a 'level playing field', often based on what time and investment it might take for domestic industry to compete or regain competitiveness. But consumers bear the higher costs. Again the discount rate is crucial in determining what level of tariff will allow domestic industry to compete, at what level domestic industry might replace existing plant and machinery, and at what level domestic industry might re-invest for the future.

[SLIDE: LACK OF COMPETITION]

Lack of competition - one of the greatest changes in Europe over the past few decades is telephony. Telecommunications has been completely transformed technologically. Fixed analogue voice lines have made way for mobile digital services that can handle data and images. Service has moved from months to install a line to walking into a shop and walking out with a phone. The privatisation and partial privatisation of state PTT behemoths is relevant to that improvement, but much more important was that privatisation coincided with competition. Similar arguments could be made for air travel, energy and water where competition has been, relatively, recently re-introduced. Even the peculiar case of state-subsidised Airbus has provided competition for Boeing and helped to reduce the cost of air travel globally. One of the classic arguments for restraining competition is that it helps to attract investment where there is a need to recoup a large infrastructure cost. The discount rate used to estimate the payback period for these large infrastructure investments is clearly crucial to see if case for restricting competition is justified. Far too often experience seems to show that restricted competition was unjustified or permitted to continue far too long. Consumers early or late in the expenditure cycle tend to be the ones who pay most.

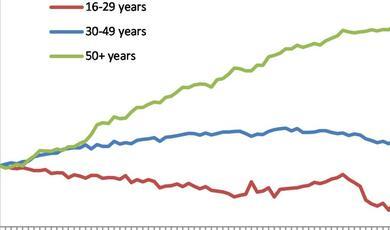

[SLIDE: UNDER-PROVISIONING]

Under-provisioning - we have already encountered this with our Victorian infrastructure example, but another gargantuan under-provisioning problem concerns pensions. The actor George Burns once quipped, 'If you live to be 100, you've got it made. Very few people die past that age.' George Burns was right. He died in 1996, aged 100. Fortunately for him, he didn't die while poor. Globally, pensions are an enormous future burden. In 1950 there were 12 people aged 15 to 64 for every person of retirement age. Today the global average is nine to one. By mid-century it will be four to one. These statistics have hit hardest in Europe and Japan, but will affect eastern Europe and Asia soon. Not surprisingly, the combination of long time frames and government has led to a huge crisis in most countries. Forty to eighty year pension plan decisions meet four to five year political cycles. Over the past decade, increased accounting transparency and mistakes in actuarial estimates coincided with bear market revaluations to the point that many large companies are pension fund liabilities with an incidental car company or steel works attached. John Plender wrote, 'British Airways, for example, could reasonably be characterized as a hedge fund with a sideline in air transport. Its viability is even more dependent on the mood swings of the equity market than on the fortunes of the airline business' [Plender, 2003 page 223] In the UK, this pension crisis was compounded by a £5 billion per annum tax grab from 1997 (ignoring compound growth) with the abolition of dividend tax credits. In the public sector, the UK government admitted that the unfunded public pension fund liability amounted to £460 billion as of 31 March 2004 based on a discount rate of 3.5%. However, in a world of lower returns the Government Actuary's retirement revised the discount rate to 2.8% and increased the estimate of unfunded public pensions fund liability at £650 billion, with a bonus of unfunded local government pension schemes of £70 billion. £720 billion in total. 60% of GDP. On 31 March this year, the discount rate was lowered to 1.8% for pension liabilities and some private actuarial firms now estimate public pension fund liabilities at £1 trillion, i.e. twice annual public expenditure.

[SLIDE: EXTERNALITIES]

Externalities - An externality occurs when an economic activity affects someone who is not party to the transaction. Pension under-provisioning is an externality as future generations will have to find some way to support penurious pensioners, but future generations were not party to the botched transactions that led to the under-provisioning. There are positive externalities, such as benefiting from your neighbours making their house more attractive, and negative externalities, such as second-hand or 'passive' smoking. The economy does not put a value on everything. While you might think that I'm going for a cheap joke about an accountant/actuary/economist knowing the cost of everything and the value of nothing, most of our biggest issues around non-sustainability arise precisely because resources are not internalised to the economy. There are good examples of resource externalities in fisheries and forests. Left outside property rights systems, many common resources thus lie outside the economy and are not subject to robust economic decisions. This is not to say that internalising externalities is easy, which we shall come to shortly in the case of climate change.

Ø Subtle Steal

Ø Typical Warning Signs

Ø Regressive taxation

¨ social cohesion

¨ essential revenue

Ø Waste

¨ public sector investment

¨ public good

Ø Biased social services

¨ universal coverage

¨ postcode lotteries

Ø Subsidies

¨ quotas, voluntary export restraints, tariffs

¨ 'level playing field', unfair competition

Ø Lack of competition

¨ national champions, national security

¨ structured or 'smart' procurement

Ø Under-provisioning

¨ pay-as-you-go, public-private partnership

¨ public safety net

Ø Externalities

¨ public commons

¨ free-riders

I would like to end our exploration of these Seven Subtle Steals by returning briefly to politics. In a fascinatingly honest critique of government debt, Mark Field MP (Cities of London and Westminster, Conservative) critiqued the lack of transparency surrounding PFI and pensions. He stated:

'...there is no easy way out. In essence, today's pensioners and those retiring in the near future will be able to rely on considerably more generous benefits than those just entering the workplace, who will pay for those liabilities. Given that there are twice as many voters over 55 as there are under 35, and that they are twice as likely to vote, it is unrealistic, to put it mildly, to expect anyone in the political arena - on either side of the political divide - to stand up and state some fairly bald facts on this matter - We are consuming what we believe we are entitled to without regard to the costs, and future generations will have to meet the liabilities for that short-sighted and selfish approach.'

[Hansard, 20 February 2007, 65-69WH -http://www.publications.parliament.uk/pa/cm200607/cmhansrd/cm070220/halltext/70220h0010.htm

Climate Change

[SLIDE: A STERN REBUKE]

So what's the answer? Just eliminate the seven subtle steals and make investment decisions properly? Well, not exactly. It might be useful to look at a topical subject in a bit more depth to see that things aren't so easy. Climate change. In a lecture two years ago, [Gresham College: 'Danish Fairy Tales - From Andersen And The Copenhagen Consensus Towards A Theory Of Commerce', 19 September 2005] I pointed out that the 2003 Copenhagen Consensus attempted to get leading economists, including Nobel Prize winners, to do cost/benefit analysis on 33 challenges to humanity. They concluded that public policy monies were best spent on curing the communicable diseases of AIDS and malaria, liberalising trade and tackling malnutrition and hunger by providing micronutrients. Climate change was not considered important.

Yet, on 30 October 2006, HM Treasury released a 692 page report on the subject of global warming and climate change - 'The Economics of Climate Change' by Sir Nicholas Stern. The conclusions of the report are that climate change could seriously impact growth, the costs of stabilising the climate are significant but manageable, global action is required and that genuine options exist. The recommendation is for a UK and international response based on emissions trading, technology cooperation, action to reduce forestation and international funding for adaptation.

[SLIDE: STAINLESS STEALS]

In fact, climate change gives us an excellent opportunity to review our seven subtle steals in reverse order:

¨ externalities - greenhouse gas emissions are economic decisions that harm those not party to the transactions that created them. Stern notes that this externality is global, persistent, develops over time, contains great uncertainties and could require massive changes ('non-marginal changes'). Internalising these costs means trading carbon emission right or imposing carbon taxes, or both, ideally globally;

¨ under-provisioning - since the industrial revolution began, in roughly 1750, CO2 levels have risen from 280 parts-per-million (ppm) to 380 ppm today. Further, CO2 is not the only greenhouse gas. Expressed in CO2equivalents the appropriate figure for all greenhouse gases is closer to 430 ppm, and continues to rise at around 2.3 ppm per annum. These ppm numbers are fairly scary if you believe, as many do, that numbers above 450 ppm, and certainly above 550 ppm, risk a significant change in the earth's climate. Perhaps the Victorians got even with us with CO2. CO2 is estimated to remain in the atmosphere before being reabsorbed, on average, about 50 to 200 years later. Most of what's up there was put there by our forebears and rest of the developed world. Developing countries have an interesting argument if they say 'remove your carbon', not just reduce your emissions, to make way for ours. But we see no historic accruals or provisions for reducing CO2 growth rates, let alone reducing CO2 levels from where they are. This is not surprising though as the externality wasn't priced;

¨ lack of competition - because fossil fuels don't have to pay carbon emission costs, they are unfairly advantaged against non-fossil fuel energy sources;

¨ subsidies - numerous subsidies exist for fossil fuels ranging from coal fields to oil and gas development in many countries. These subsidies may even increase in line with growing concern and stridency about 'security of energy supply', although a more optimistic reading is that 'security of supply' concerns might aid alternative energy. To add insult to injury, the one clearly effective, carbon-displacing biofuel is bioethanol from tropical sugarcane, rather than most biofuels grown in the EU or the USA. However, Brazilian bioethanol is subject to tariffs in the EU and the USA, as is Brazilian sugar. For those of you wondering whether a Brazillion is much bigger than a trillion - here are a few figures. Brazil's bioethanol sales price varies in the range of '200-300/ton of oil equivalent (toe), compared to about '400/toe for the US and '750-850/toe for the EU. The import duty to the EU adds an additional '300/toe making the costs of Brazilian bioethanol magically comparable to European production prices;

¨ biased social services - there has been tremendous focus in the UK on the potential personal impact of climate change. However, it is more likely that underdeveloped countries, e.g. Saharan and sub-Saharan Africa, are already feeling the effects. Interestingly, one of the more equitable solutions to climate change is called Contraction & Convergence, promoted by Aubrey Meyer of Global Commons Institute. He points out that a simple solution to climate change is to cap emissions on a per capita basis and then contract per capita emissions towards convergence at a sustainable level. In the process, the per capita emissions would be tradable. As a consequence, there would be significant payments from high-emitting, developed countries to poorer, low-emitting countries. In extreme cases, a few hundred dollars per person could be sent to poorer countries to purchase their carbon emission rights. Aubrey's proposals seem less biased than most other proposals, but have been attacked as unrealistic or politically naïve;

¨ waste - many of the recommendations to prevent climate change focus on improving efficiency. Perversely, some existing efficiency measures, such as insulation improvements, fuel efficient vehicles and better lighting systems would already pay for themselves without a social cost of carbon, but we are wasteful;

¨ regressive taxation - the poor bear most of the costs. Many existing so-called carbon taxes, for instance fuel taxes or airport taxes, fall disproportionately on the poor.

There have been many positive responses to the Stern review. It is clearly an important piece of work bringing together many important threads into one document. It is also a brave work, daring to try and encompass an enormous subject and exposing the author(s) to global critique. Naturally, there have been many negative responses. The criticisms include assertions that Stern's assumptions were pessimistic, that when faced with a choice the report chose the most pessimistic outcomes, that Stern ignores the potential for technological change, and that Stern's social cost of carbon is out of the normal range. Stern's social cost of CO2 is well above other reputable studies that estimate, based on different assumptions, anything from $2.50/tCO2 towards an emerging consensus around $30 to $40/tCO2. Stern's social cost of carbon might be around $85/tCO2 though it is important to stress that he notes, 'Further work on what social cost of carbon corresponds to potential stabilisation levels is needed.' [Stern, 2006, page 344]

[SLIDE: CLIMATE CHANGE]

Stern points out that ethics is at the heart of the economics. He believes that future generations should be protected from harm, that future generations should have a right to a standard of living no lower than the current one, and that the world should be passed on in at least as good a state as inherited from the previous generation. [Stern, 2006, pages 46-48]

The report suggests committing 1% of GDP, the same as the $480 billion Garga Project, each year to cut carbon emissions. Dasgupta and others criticise Stern for ignoring the rights of people currently living on the planet to a standard of living no lower than others. By comparison Bjørn Lomborg claims that 'Spending just a fraction of this [Stern Review] figure - $75 billion - the UN estimates that we could solve all the world's major basic problems. We could give everyone clean drinking water, sanitation, basic health care and education right now. Is that not better?' Again, our argument is as much about equality as intertemporal transfer. If global population keeps on growing, do we owe future generations a planet as good as the one we have on an absolute or a per capita basis?

So, eminent economists disagree wildly about an important subject. Interestingly, a central economic issue in the debate is the discount rate. Stern concludes that the appropriate pure time discount rate to be applied to climate change decisions is very low, 0.1%. Stern is examining future consumption streams, so he is correct to focus on the pure rate of time preference - the rate at which future consumption ought to be discounted to make it equivalent in social value to consumption today, rather than typical public or private sector discount rates. A related argument is that the discount rate you choose is an ethical question based, to some degree, on whether you care about the future. 'If you do not care about the long-term future, simply because it is in the future, you will not care about climate change.' Stern does not reach this low pure rate of time preference rate conclusion lightly. He devotes an annex to his second chapter on 'Ethical Frameworks and Intertemporal Equity' - basically about the relationship between the discount rate, the pure rate of time preference and intergenerational transfers. In response to questions, he said:

'Many previous studies have used higher rates of pure time preference, which are similar to those used for evaluating other kinds of investments. However, we argue that this disinvestment in the environment cannot be considered in, say, the same way as an economist would consider an investment in a railway. A railway can be replaced or redesigned, it can become obsolete or redundant. In other words, the probability of survival depends on the context. In this case the context is that of the whole planet.'

Dis-count Me Out

To some degree, Stern's rate is closer to the real interest rate for government bonds, while his critics prefer rates closer to the weighted average cost of capital for private companies. Government discounting practice is to use a discount rate that falls over time in order to avoid 'discounting away' long-term problems such as climate change. You will remember that a very low discount rate benefits projects that have long-term benefits in the distant future. In Stern's words, 'a high rate of discounting of the future will favour avoiding the costs of reducing emissions now, since the gains from a safer and better climate in the future are a long way off and heavily discounted (and vice versa for low discount rates).' [Stern, 2006, pages 50 and 51] However, we must be clear that Stern's 0.1% is the pure rate of time preference for intergenerational transfer. Discount rates for investment decisions are not the same thing and will change over the period of climate change and be different under changing circumstances. Quite rightly, Stern says, 'Thus the question 'what is the discount rate?' is badly posed. There will be many discount rates depending on the period of time and the path.' [Stern rebuttal, 2007]

The discount rate is 'relevant only for marginal analysis and thus is not of direct significance for changes involving non-marginal impacts.' The pure rate of time preference is 'an integral feature of the overall set of values and is relevant for all applications marginal or non-marginal. Its ethical status, however, requires careful examination.' When Stern says 'non-marginal', he means that the results of doing nothing could be catastrophic. In other words, the discount rate analysis we went through earlier is fine for comparing investments in competing projects such as Micro-Projects and Mega-Projects, but not for comparing wildly different projects. And not for valuing Garga-Projects if the alternative is extinction.

Another way of looking at this is that you can use the discount rate to evaluate a game of Russian roulette, but you have to accept the chance of dying. If you don't want to die during the game under any circumstances, then discount rate analysis is useless. Stern again, 'the pure time discount rate applying to the existence or non-existence of the planet should be much lower than that applying to the existence or non-existence of a project in terms of a possible new environment (from unforeseen policies or technical change, for example) which would render that project irrelevant.'

[SLIDE: STEALING FROM OURSELVES]

Of course, we could also be ripping ourselves off. Stern points out that his mitigation cost estimates of 1% of world GDP is equivalent to GDP in 2100 being '940% higher than today, as opposed to 950% higher if there were no climate-change to tackle'. [Stern, 2006, page 278] Professor Nordhaus points out that the assumptions used in the Stern Review imply that global per capita consumption in 2200 will be $94,000 [perhaps more comparably in 2100 about $26,000] as compared to $7,000 today and asks is it ethical to transfer wealth from someone making $7,000 a year to someone making $94,000 a year?

Statistician Samuel Karlin once said, 'The purpose of models is not to fit the data but to sharpen the questions.' So we understand that a high discount rate means we don't care about the future, while a low discount rate means we do. We learn that before subjecting a range of outcomes to discount rate analysis, we have to be capable of accepting all the possible outcomes. We realise that discount rate or cost-benefit analysis can only show that the benefits of a policy exceed the costs. There will be winners and losers. If the winners don't wish to compensate the losers for their losses, the policy may not be politically achievable. Finally, if we want to apply fair intergenerational transfer, we may need a very low, near zero, discount rate. Perhaps those Victorians weren't so foolish after all.

Given all this uncertainty, it probably helps to know that there are two types of economists:

(1) those who cannot calculate the correct discount rate,

and

(2) those who do not know that they cannot calculate the correct discount rate.

Part of the problem with the discussion around the Stern Review's discount rate is that ethical arguments are being used to justify a discount rate. It's not at heart an economic question. If I believed eradicating malaria was more important than climate change, I might deploy ethical arguments to support a discount rate of zero for finding a way to eliminate the malaria parasite, below the Stern Review's discount rate for climate change. A third person convinced of peak oil might even argue for a negative discount rate; today's oil is worth less than tomorrow's oil given future scarcity.

[SLIDE: DISCUSSION]

If we truly care about the dispossessed, the poor and our own children, we need to make sure that (1) the facts are clear, (2) we suppress the seven subtle steals, and (3) when we agree on the order of things, we use discount rates appropriately, with very low rates for the longer term.

We are not arguing pure economics. We are arguing about what goals are more important. After we agree the priorities and the relative ranking of the goals, we can use discount rate analysis to help us choose options within each goal given the overall discount rate. Until we agree our priorities, you can count me in on the political discussions, and count me out of the economic discussions.

Thank you.

Discussion

1. Are discount rate techniques appropriate under great uncertainty?

2. Is politics the only framework for long-term policy formulation?

Further Reading

1. GODFREY, John, 'Surviving the 'Dogfood Years': Solutions to the Pensions Crisis', Centre for the Study of Financial Innovation, 2005.

2. GUO, Jiehan, HEPBURN Cameron J, TOL Richard S J and ANTHOFF, David, 'Discounting and the Social Cost of Carbon: A Closer Look at Uncertainty', Environmental Science and Policy, Volume 9, 2006, pages 205-216 - http://www.fnu.zmaw.de/fileadmin/fnu-files/publication/tol/espmargcost.pdf

3. LOMBORG, Bjørn (ed) et al, Global Crises, Global Solutions: Priorities for a World of Scarcity, Cambridge University Press, (2004).

4. PLENDER, John, Going Off The Rails: Global Capital And The Crisis Of Legitimacy, John Wiley & Sons, 2003.

5. STERN, Nicholas, The Economics of Climate Change: The Stern Review, Cabinet Office - HM Treasury, Cambridge University Press (2006).

Further Surfing

1. Matthew Parris' Times article of 8 November 2007 -http://www.timesonline.co.uk/tol/comment/columnists/matthew_parris/article2826038.ece

2. Tom Winsor's letter of 4 July 2004 - http://www.rail-reg.gov.uk/upload/pdf/foi_67.pdf

3. New York Times observations on the Stern Review -http://www.nytimes.com/2007/02/21/business/21leonhardt.html?ex=1329714000&en=846690277bf060af&ei=5090&partner=rssuserland&emc=rss

4. Professor Robert Mundell, 'Uses and Abuses of Gresham's Law in the History of Money', Columbia University, August 1998 -http://www.columbia.edu/~ram15/grash.html.

5. Victorian water mains -http://news.bbc.co.uk/1/hi/business/3538428.stm

6. An academic look at UK water privatisation -http://www.psiru.org/reports/2001-02-W-UK-over.doc

7. Compound interest and the Rule of 72 -http://en.wikipedia.org/wiki/Rule_of_72

8. Contraction & Convergence, the Global Commons Institute -http://www.gci.org.uk/

9. The Green Book - Consultation Paper, how HM Treasury applies the discount rate - http://www.hm-treasury.gov.uk/media/6/8/greenbk_consultation.pdf

10. Nice critique of Pure Time Preference Theory -http://www.mises.org/journals/scholar/murphy2.pdf

11. Pensions - The Pensions Institute discusion paper, 'Is There A Pension Crisis In The UK?' - http://www.pensions-institute.org/workingpapers/wp0401.pdf

12. Bjørn Lomborg's thoughts on the Stern Review -http://www.opinionjournal.com/extra/?id=110009182

13. Richard S J Tol's thoughts on the Stern Review -http://www.fnu.zmaw.de/fileadmin/fnu-files/publication/tol/RM7241.pdf & Tol & Yohe - http://www.fnu.zmaw.de/fileadmin/fnu-files/publication/tol/RM551.pdf & Tol & Yohe -http://www.fnu.zmaw.de/fileadmin/fnu-files/publication/tol/tolyohe-stern-we2.pdf

14. Sir Partha Dasgupta's thoughts on the Stern Review -http://www.econ.cam.ac.uk/faculty/dasgupta/STERN.pdf

15. Stern Review FAQs - http://www.hm-treasury.gov.uk/media/0/3/faq.pdf

16. Stern's responses to some criticisms - 'Value judgements, welfare weights and discounting: issues and evidence' - http://www.hm-treasury.gov.uk/media/C/8/Paper_B.pdf

17. Fun online discount rate tutorial with calculations -http://hspm.sph.sc.edu/COURSES/ECON/Dis/Dis.html

Thanks

My thanks to Jan-Peter Onstwedder for prompting several ideas in this talk, though that hardly means he agrees with it!

©Professor Michael Mainelli, Gresham College, 12 November 2007

This event was on Mon, 12 Nov 2007

Support Gresham

Gresham College has offered an outstanding education to the public free of charge for over 400 years. Today, Gresham plays an important role in fostering a love of learning and a greater understanding of ourselves and the world around us. Your donation will help to widen our reach and to broaden our audience, allowing more people to benefit from a high-quality education from some of the brightest minds.

Login

Login