China’s Economic Prospects on the Cusp

Share

- Details

- Text

- Audio

- Downloads

- Extra Reading

China has important islands of technological excellence, even dominance, but these islands exist in a sea of macroeconomic imbalances and headwinds. Xi Jinping is adamant that by focusing on technology, and other aspects of national security, China can hold sway in the global system and determine global governance. Many western economists and even some in China are not so sure, choosing to wonder if the government has the political capacity to address deep-seated economic problems.

Download Text

China’s Economic Prospects on the Cusp

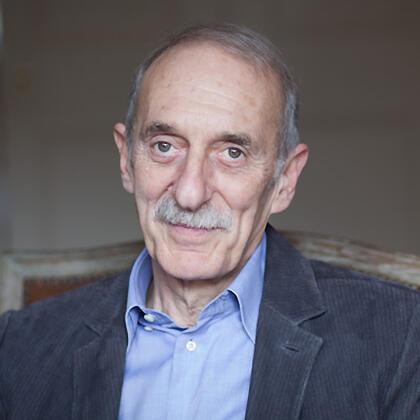

George Magnus, Economist and Author

Monday 3 Nov 2025

The Central Committee of the Chinese Communist Party (CCP) convened and concluded an important political meeting in October, the consequences of which will take time to assess. The so called Fourth Plenum’s principal tasks were to approve both the 15th Five Year Plan (FYP)(2026-2030), which will be unveiled next March at the National People’s Congress, and key personnel changes.

The leadership of the CCP struck a confident and assertive tone in assessing the Chinese economy’s capacities and prospects. With Chinese manufacturing already at a high-water mark, accounting for a third of the global total, the government is totally committed to the pursuit of what is already an unparalleled scale of industrial policy, and to what Xi Jinping calls high quality development, along with self reliance in key areas and sectors deemed important national security.

The emphasis on green technologies, strong manufacturing, exploration of the boundaries of science and innovation is unmistakable and there is little question that China wants, as Xi says, to dominate the so-called fourth industrial revolution in advanced technologies, AI, biomedicine, quantum computing, aerospace and so on.

This sort of rhetoric and confidence, though, conveniently masks the government’s continuous attempts to stimulate the economy in the face of persistent deceleration. That said, it is also true that in China, there is a widening bifurcation of the economy between a relatively small, dynamic, modern manufacturing and technology sector comprising some world class brands and products, and the rest of the economy featuring swathes of loss making firms, waste, and overproduction, and misallocation of capital.

This is why it is interesting to ask whether the China’s economy is at an inflection point where, for example, its industrial strength will pull the rest of the economy out of the doldrums, or more likely, if the coming years will witness a deepening of this duality in which closure might look less benign.

It is worth pointing out some background. Unlike in other countries where GDP is a recorded economic outcome of spending and production, the official Chinese GDP numbers are a political data series, devoid of cyclicality, and the outcome of spending and borrowing decisions by state agencies to meet a pre-announced target. Normally China’s GDP embeds upward bias. The July-September quarter may be an exception because local governments may have over-reported a decline in investment to show they were meeting Beijing’s recently announced goal of curbing overproduction and disorderly competition, aka involution competition. In any event, real estate remains depressed, infrastructure investment is waning again, and even manufacturing investment is very soft.

China’s growth has slowed over the last decade and has become increasingly reliant on annual stimulus measures, mostly in the form of borrowing authority to finance infrastructure and directed credit, to meet unsustainably high growth targets. This may fulfil political goals, but at the cost of misallocated capital, bad loans, and fiscal and financial instability risk.

Taking all these factors into account, the softness of household spending, especially in the wake of the enduring real estate downturn, and the weakness of employment, the underlying and sustainable growth rate, allowing for inflation, in China may be no more than 3-3.5 per cent. Yet, even using official statistics, China’s GDP growth measured in money terms is rising at under 4 per cent because broad measures of inflation have actually fallen for the last 3 years. The window some people thought existed for China’s GDP to overtake the United States sometime in the 2020s has closed. It may now never happen, and hardly anyone refers it nowadays.

Much of China’s growth has reverted to a playbook that is 15-20 years old, and from which it was thought, China would move on, namely exports. Even though exports shipped direct to the United States have dropped by over 25 per cent in 2025, re-routing and transhipment via third countries, as well as a push by Chinese firms to sell more in Europe and Africa, has lead to soaring trade surpluses and growing disquiet among foreign nations about the trend. Chinese officials and many commentators have been talking for years about the need for China’s economy to rebalance towards more household consumption, the opening up of service industries to competition, and a more prominent role for private firms, but this agenda is antithetical in many ways to what the government is actually prioritising.

Whether China, then is on a precipice or a plateau is key topic for the coming decade. For the time being it is certainly the case that two things can be simultaneously true; China has both a dynamic modern sector with world class brands and its own innovative capacity, and a larger more stagnant economy harbouring imbalances, inequality, and deep macroeconomic problems.

© George Magnus 2025

References and Further Reading

Nicolas Borst, The Economic Costs of China’s Self-Reliance Drive, China Leadership Monitor, Issue 85, September 2025, https://www.prcleader.org/post/the-economic-costs-of-china-s-self-reliance-drive

Ding, Jeffrey, The Innovation Fallacy, Foreign Affairs, 19 August 2024, https://www.foreignaffairs.com/china/innovation-fallacy-artificial-intelligence

Doshi, Rush, The United States, China, and the contest for the Fourth Industrial Revolution, Brookings, July 31, 2020 https://www.brookings.edu/articles/the-united-states-china-and-the-contest-for-the-fourth-industrial-revolution/

Lardy, Nicholas (2019), The State Fights Back, Peterson Institute for International Economics

IMF, Industrial Policy in China: Quantification and Impact on Misallocation, Working paper WP/25/155, August 2025, https://www.elibrary.imf.org/view/journals/001/2025/155/001.2025.issue-155-en.xml?cid=568888-com-dsp-crossref

Magnus, George (2018), Red Flags: Why Xi’s China is in Jeopardy, Yale University Press (available in the China Centre library). Newly commissioned material in paperback version (2019)

Magnus, George, China’s Quixotic Quest to innovate, Foreign Affairs, 29 May 2024, https://www.foreignaffairs.com/china/chinas-quixotic-quest-innovate

Magnus, George, China’s Industrial policy, Trade and the Global Order, https://www.geostrategy.org.uk/research/chinese-industrial-policy/ Council on Geostrategy, October 2025

Naughton, Barry, (2021), The Rise of Chinese Industrial Policy 1978-2020, Lynne Rienner Publishers Inc.

Naughton, Barry, Testimony to the US China Economic and Security Review Commission, 6 February 2025, https://www.uscc.gov/sites/default/files/2025-02/Barry_Naughton_Testimony.pdf

DiPippo, Gerard, Mazzocco, Ilia, Kennedy, Scott, and Goodman, Matthew P., Red Ink: Estimating Chinese Industrial Policy Spending in Comparative Perspective, CSIS, 23 May 2022, https://www.csis.org/analysis/red-ink-estimating-chinese-industrial-policy-spending-comparative-perspective

Posen, Adam, The End of China’s Miracle, Foreign Affairs, 2 August 2023, and Zongyuan Zoe Liu & Michael Pettis responses, Foreign Affairs, 3 October 2023

Rozelle, Scott, and Hell, Natalie (2020), Invisible China, University of Chicago Press

Setser, Brad, China’s Stealth Trade Surplus, Council On Foreign Relations, 7 July 2025, https://www.cfr.org/blog/chinas-stealth-trade-surplus

Seafarer, Nobody Wins in a Price War; Destructive Competition in China, Prevailing Winds, September 2025, https://www.seafarerfunds.com/prevailing-winds/destructive-competition-in-china/

Wright, Logan et al, How Can China Boost Consumption, Rhodium Group, 10 February 2025, https://rhg.com/research/how-can-china-boost-consumption/

Wright, Logan, China’s Economy Has Peaked: Can Beijing Redefine its Goals? China Leadership Monitor, 31 August 2024, https://www.prcleader.org/post/china-s-economy-has-peaked-can-beijing-redefine-its-goals

Dan Wang, Breakneck: China’s Quest to Engineer The Future, Allen Lane, 2025

Nicolas Borst, The Economic Costs of China’s Self-Reliance Drive, China Leadership Monitor, Issue 85, September 2025, https://www.prcleader.org/post/the-economic-costs-of-china-s-self-reliance-drive

Ding, Jeffrey, The Innovation Fallacy, Foreign Affairs, 19 August 2024, https://www.foreignaffairs.com/china/innovation-fallacy-artificial-intelligence

Doshi, Rush, The United States, China, and the contest for the Fourth Industrial Revolution, Brookings, July 31, 2020 https://www.brookings.edu/articles/the-united-states-china-and-the-contest-for-the-fourth-industrial-revolution/

Lardy, Nicholas (2019), The State Fights Back, Peterson Institute for International Economics

IMF, Industrial Policy in China: Quantification and Impact on Misallocation, Working paper WP/25/155, August 2025, https://www.elibrary.imf.org/view/journals/001/2025/155/001.2025.issue-155-en.xml?cid=568888-com-dsp-crossref

Magnus, George (2018), Red Flags: Why Xi’s China is in Jeopardy, Yale University Press (available in the China Centre library). Newly commissioned material in paperback version (2019)

Magnus, George, China’s Quixotic Quest to innovate, Foreign Affairs, 29 May 2024, https://www.foreignaffairs.com/china/chinas-quixotic-quest-innovate

Magnus, George, China’s Industrial policy, Trade and the Global Order, https://www.geostrategy.org.uk/research/chinese-industrial-policy/ Council on Geostrategy, October 2025

Naughton, Barry, (2021), The Rise of Chinese Industrial Policy 1978-2020, Lynne Rienner Publishers Inc.

Naughton, Barry, Testimony to the US China Economic and Security Review Commission, 6 February 2025, https://www.uscc.gov/sites/default/files/2025-02/Barry_Naughton_Testimony.pdf

DiPippo, Gerard, Mazzocco, Ilia, Kennedy, Scott, and Goodman, Matthew P., Red Ink: Estimating Chinese Industrial Policy Spending in Comparative Perspective, CSIS, 23 May 2022, https://www.csis.org/analysis/red-ink-estimating-chinese-industrial-policy-spending-comparative-perspective

Posen, Adam, The End of China’s Miracle, Foreign Affairs, 2 August 2023, and Zongyuan Zoe Liu & Michael Pettis responses, Foreign Affairs, 3 October 2023

Rozelle, Scott, and Hell, Natalie (2020), Invisible China, University of Chicago Press

Setser, Brad, China’s Stealth Trade Surplus, Council On Foreign Relations, 7 July 2025, https://www.cfr.org/blog/chinas-stealth-trade-surplus

Seafarer, Nobody Wins in a Price War; Destructive Competition in China, Prevailing Winds, September 2025, https://www.seafarerfunds.com/prevailing-winds/destructive-competition-in-china/

Wright, Logan et al, How Can China Boost Consumption, Rhodium Group, 10 February 2025, https://rhg.com/research/how-can-china-boost-consumption/

Wright, Logan, China’s Economy Has Peaked: Can Beijing Redefine its Goals? China Leadership Monitor, 31 August 2024, https://www.prcleader.org/post/china-s-economy-has-peaked-can-beijing-redefine-its-goals

Dan Wang, Breakneck: China’s Quest to Engineer The Future, Allen Lane, 2025

Part of:

This event was on Mon, 03 Nov 2025

Support Gresham

Gresham College has offered an outstanding education to the public free of charge for over 400 years. Today, Gresham College plays an important role in fostering a love of learning and a greater understanding of ourselves and the world around us. Your donation will help to widen our reach and to broaden our audience, allowing more people to benefit from a high-quality education from some of the brightest minds.

Login

Login