The Privatisation of Law: Has a World Court finally been created by modern international arbitration?

Share

- Details

- Text

- Audio

- Downloads

- Extra Reading

This is the 2013 annual Gray's Inn Reading.

Other Gray's Inn Reading lectures can be accessed here:

2012 - Privacy and Publicity in Family Law - Their Eternal Tension by The Rt Hon Sir Nicholas Wall

2011 - Beanstalk or living instrument?

by the Rt Hon the Baroness Hale of Richmond

2010 - The creation of the supreme court by Lord Hope of Craighead LLD FRSE

2009 - Sisters-in-Law by The Hon Michael Beloff QC

2008 - Terrorism: Cold War or Bad Law? by Lord Carlile of Berriew QC

2007 - Access to Justice: Keeping the doors open by Michael Napier CBE QC

2006 - The International Dimension of Judicial Review

by The Rt Hon Sir Stephen Richards

2005 - Family Law: Rights and social consequences

by The Hon Dame Joyanne Bracewell DBE

2004 - Tackling Cross border crime by Clare Montgomery QC

Download Text

27 June 2013

The Privatisation of Law:

Has a World Court finally been created

by modern international arbitration?

The Rt Hon The Lord Goldsmith QC

I. introduction

At the 2012 International Council for Commercial Arbitration (“ICCA”) Congress, Sundaresh Menon SC, the then Attorney-General (and current Chief Justice) of Singapore gave a prize-winning keynote speech. He spoke of the international arbitration “industry” and its “critical role in the global administration of commercial justice”.[1] He later described arbitration as a “free market model of adjudication”.[2]

For some such words may jar because: (i) rendering justice should not be conceived of as an “industry” it should be a public service. Although lawyers are financially remunerated, the courts do not (overtly) operate as profit centres;[3] (ii) except with regard to inter-State relations, justice should be devised and applied on a national level, not “globally administered”; and (iii) dispute resolution should not be corrupted by market forces.

Yet his description of international arbitration was apt. As a wholly consensual dispute resolution mechanism, distinct from the public justice system embodied by national courtsand most often shrouded by confidentiality, arbitration is a privatised system of law.

Moreover, international arbitration is indubitably a service industry, designed and evolving to meet the needs of its key potential “consumers” (notably corporations and, to a lesser extent but increasingly, States). The service providers are the counsel, the arbitrators, the institutions[4] and the purpose-built arbitration centres that are springing up (notably Maxwell Chambers in Singapore and Arbitration Place in Toronto; the latter’s website referring to its “concierge team”, its “Herman Miller Aeron chairs” and its “urban woodland” “Cloud Garden”).

As to its global credentials; arbitration is practised by lawyers in international firms disregarding State borders (or time zones). It is administered by institutions that welcome parties of any nationality, without restriction regarding the location of the underlying dispute, the seat of the arbitration or the physical siting of any arbitration hearing. An arbitral tribunal often comprises of arbitrators differing nationalities who are willing to apply whatever the governing law may be. I am, for example, involved in one arbitration where a German lawyer will be determining issues of Japanese law in a London-seated arbitration; another where the interpretation of Uzbek legislation will be considered by Dutch and American lawyers.

Thus, international arbitration is a global privatized service industry. The ensuing question I intend to consider this evening is whether modern international arbitration has created a World Court?

From time to time the creation of a World Court has been called for. For example, nearly thirty years ago Hans Smit, a Columbia Law School professor identified as a “towering figure in international arbitration”, posed the question: “The Future of International Commercial Arbitration: A Single Transnational Institution?”[5] He identified “the rapidly increasing number of international arbitration institutions with different rules and processes administered by persons of different training and competence” which, he reasoned, failed effectively to serve “the needs of international intercourse”. His solution was “to create a single international institution”.[6] More recently, John Templeman, a U.S. based arbitration practitioner, has proposed the creation of a permanent international court of arbitration.[7] However, notwithstanding the current absence of a single institution, I think it apt to consider whether modern international arbitration has sufficiently developed to create a de facto World Court.

Of course, identifying what I mean by a World Court is clearly imperative and I will endeavour to take on that task. However, a preliminary step is to confirm the international legitimacy of arbitration. For this, I will delve briefly into its history.

II. History of arbitration

Arbitration has a rich history, worthy of a lecture on its own. It can be traced back to Ancient Greece. It is referenced in Homer’s Iliad where it was employed as a means of resolving a blood debt. Thereafter, from the Roman Empire through the Middle Ages, arbitration was in regular use across Europe.[8] There is evidence of arbitration being used more than 500 years before the rise of the common law. One legal historian explains that “arbitration was, perhaps, the habitual mode of settling dispute among the Anglo-Saxons”.[9]

My purpose in presenting this historical background is not only to demonstrate the longevity of arbitration and its international roots but to illustrate that historical features and perceived benefits of arbitration have persisted. Commenting on the advantage of arbitration, Demosthenes wrote of the ability of parties to select the arbitrator and the finality of an arbitration award. Modern-day arbitration proponents frequently recite these features of arbitration. Likewise, in medieval England, arbitration provided merchants engaged in international trade with an efficient and comprehensible process for dispute resolution which was welcomed by foreign parties who found the technicalities and inconsistencies of the common law confusing. In modern times, international commercial arbitration has been described as “the servant of international business and trade”.[10]

Historically, however, arbitration was an ad hoc process. It would have been impossible to discern a World Court from such a patchwork of arbitrations. More recently, the development and growth of international arbitration has been driven by a number of global initiatives that have sought to develop a more cohesive international framework and engender a consistency of process that appeals to parties. Singling out three key developments (indubitably a contentious exercise), I would identify:

First, the 1958 New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards (the “New York Convention”). 149 States are party to the New York Convention.[11] Its premise – that an arbitral award rendered by a tribunal seated in one Member State can be directly enforceable in another Member State – has been an enormously significant development in international arbitration. It has made arbitration awards a global currency. With a single treaty, an arbitration award rendered in Azerbaijan is enforceable in Fiji or 147 other States. The popularity of arbitration as a dispute resolution mechanism must, in part, be attributed to the success of the New York Convention measured by the number of adhering States and the general respect it is afforded by national courts.

Second,the 1965 Washington International Centre for Settlement of Investment Disputes Convention (the “ICSID Convention”) was another landmark treaty that furthered the cause of international arbitration although, in this case, specifically investment treaty arbitration between investors and States. That Convention established ICSID, an independent international institution that forms part of the World Bank Group. Though the ICSID Convention itself does not establish consent to arbitration, by signing it, 158 signatory States have demonstrated their commitment to resolving investment disputes by arbitration within an autonomous legal framework.

The ICSID Convention ushered in the era of the investment treaty. By affording foreign investors substantive protections (such as the right to fair and equitable treatment and protection from unlawful expropriation) that they can directly enforce through arbitration against the host State of their investment, investment treaties have revolutionised the arbitration landscape. In 1965 there were only a handful of investment treaties. By the end of 2011, there were 2833 bilateral investment treaties,[12] supplemented with a number of free trade agreements (e.g. NAFTA, DR-CAFTA) and multilateral treaties (e.g. the Energy Charter Treaty) with investment chapters providing for international arbitration.

Finally, the establishment of the United Nations Commission on International Trade Law (“UNCITRAL”) by the United Nations in 1966,[13] with its general mandate to further the progressive harmonization and unification of the law of international trade, was a boon to international arbitration. The UNCITRAL Arbitration Rules (first drafted in 1976, updated in 2010) are often used for ad hoc arbitrations and are commonly referenced in arbitration clauses found in both commercial contracts and investment treaties. The 1985 UNCITRAL Model Law on International Commercial Arbitration (updated in 2006) has provided a “best practice” model, supportive of arbitration, and been the genesis for much of the international harmonization of States’ arbitration legislation.

Beyond the practical implications of these treaties and global initiatives (upon which I will expand later), these developments are significant because of the international legitimacy they have conferred upon arbitration. They demonstrate that States recognise arbitration as a valid and important dispute resolution forum. Thus, from its historical background (ancient, mediaeval and modern) it is incontrovertible that arbitration has both an illustrious international provenance and legitimacy. However, whilst a necessary pre-condition, this alone is insufficient to designate arbitration as a World Court.

III. What is a world court?

As promised, I return to the question of “What is a World Court”?

Conscious of my audience, I must stress that the proposition (The Privatisation of Law: Has a World Court finally been created by modern international arbitration?”) is not akin to “judicial anarchy”. Arbitration does not represent a rejection of or opposition to national legal systems. As the eminent French arbitration professor and practitioner, Emmanuel Gaillard, observed when considering commercial arbitration as a transnational system of justice, the concept rests on arbitration being an autonomous legal order, not an a-national legal order.[14] Whatever one’s vision of arbitration the source of its legitimacy ultimately derives from the States that have acknowledged it as a valid dispute resolution mechanism by, inter alia, the treaties and initiatives already identified and whose courts afford it respect.

So, what do I mean when referring to a “World Court”?

First, I think it is necessary to consider the disputes that a body purporting to be a World Court should determine. To a certain extent a World Court must meet thresholds relating to the number and types of disputes that it resolves (what I would term a quantitative and qualitative analysis). From a quantitative perspective, the number of disputes resolved by arbitration and the frequency of arbitration clauses provide the data to determine whether arbitration is sufficiently prevalent to merit the World Court badge. From a qualitative perspective, a World Court must be adept at determining international and important disputes; whether measured by the financial amount or principle at stake.

However, to elevate arbitration from merely a popular, international and important dispute resolution mechanism to the status of a World Court requires consideration of the arbitration eco-system. As Gaillard explained in the context of considering international arbitration as a “system”; “what it connotes is that international arbitration … can be viewed as a body of norms sufficiently organized, complete, and effective to qualify as a system”.[15] A patchwork of arbitrations, however extensive, cannot claim to be a World Court unless they can be linked to form an identifiable corpus. The arbitration eco-system is the apparatus for developing those links. I use the short-hand “eco-system” to describe the framework under which arbitration operates; that includes (i) the administering institutions; (ii) the applicable rules; (iii) the arbitrators; and (iv) the enforcement mechanisms that are integral to the arbitration process. I will consider separately the contribution of each to the proposition that arbitration has created a World Court. However, in general, for arbitration to be considered a World Court its eco-system should be legitimate, cohesive and autonomous.

IV. DISPUTES RESOLVED BY ARBITRATION

Prevalence of arbitration

The logical place to start is to consider whether arbitration meets the quantitative threshold to be designated a World Court. That threshold is not necessarily high; rather it must simply be possible to conclude that arbitration is seen as a legitimate alternative dispute resolution forum by its potential users. I begin with a non-scientific numerical analysis of the arbitrations administered by the larger arbitral institutions.

In 2012, the ICC registered 759 cases, the LCIA registered 265 cases, ICSID registered 48 cases, SIAC registered 235 cases, the SCC registered 177 cases and the AAA registered 888 cases. (Since many arbitrations last for more than a year, the institutions’ on-going caseload was higher.) One trend, reflected in the statistics of every institution, is an increase in the number of cases registered since the turn of the millennium. Moreover, these numbers are not the full story. Some arbitrations are not administered by an institution but are conducted ad hoc, organized by the parties and counsel themselves. The confidentiality of a vast number of those arbitrations means that their existence is not known and they are not included in the tally. Still, the numbers are unlikely to be overwhelming to this audience given that there were 35,238 proceedings started in the High Court’s Chancery Division and 13,928 proceedings started in the High Court’s Queen’s Bench Division in 2011.[16]

Perhaps more revealing is the incidence of arbitration clauses in contracts, domestic legislation and international treaties.

It is difficult to analyse empirically the use of arbitration clauses in contracts given that they are usually confidential. However, a study of contracts filed with the SEC by U.S. public companies in 2002 identified that, on average, 20% of all contracts reviewed which included an international party included an arbitration clause.[17] More recently, another U.S. study highlighted that 71% of SEC filed international joint venture agreements in 2008 contained arbitration clauses.[18]

There is also “arbitration without privity” (to adopt the phrase coined by one of the leading figures of the arbitration community, Jan Paulsson) where “the claimant need not have a contractual relationship with the defendant” as found in domestic legislation and international treaties.[19] Thus, some States have included arbitration provisions in their domestic investment legislation. The legislation of Georgia, Albania and El Salvador has been found to include binding arbitration clauses.[20] Other States’ domestic legislation contains reference to arbitration as a dispute resolution mechanism, subject to consent (e.g., the legislation of Estonia, Indonesia and Azerbaijan). This is complemented by the vast network of investment treaties that mostly include provision for the direct enforcement of their protections by means of investor-State arbitration. [21]

Such arbitration provisions significantly extend the reach of arbitration because the State consents to arbitration in relation to a potentially indeterminate class of disputants. This is compounded by the fact that such provisions are often binding for a significant length of time and, certainly in the context of treaties, during that period are not subject to the supervision or control of any electoral mechanisms. The tribunals whose jurisdiction is founded on such clauses effectively exercise compulsory jurisdiction.[22]

On the international plane, arbitration provisions are not confined to investment treaties. For example, the United Nations Convention of the Law of the Sea (“UNCLOS”) provides for the resolution of disputes pertaining to its interpretation or application by arbitration (although not exclusively).

On the basis of this brief analysis, I think it fair to say that arbitration is sufficiently popular to conclude that it is regarded as a legitimate alternative dispute resolution mechanism for resolving international disputes involving private parties and States. This is endorsed by the growing number of dedicated arbitration practices found in many law firms.

Types of disputes

Turning to a qualitative analysis of the disputes resolved by arbitration; the designation World Court implies a certain status that requires that arbitration must resolve international and important disputes. In this respect it is worthwhile briefly to consider arbitration’s credentials in relation to (i) international disputes; (ii) high-value disputes and (iii) disputes concerning issues of public policy.

International disputes

Arbitration’s relevance as a means of resolving international disputes (i.e., disputes involving parties from different States) is widely-recognised. From my own experience I can attest to the truly international nature of arbitration. As its historical provenance suggests, arbitration is particularly suitable for international disputes where the parties seek a neutral forum and, in particular, where the parties do not have confidence in the courts that would otherwise provide the forum conveniens. The flexibility of arbitration means that the parties can choose the location for any oral hearings, the applicable substantive law and the seat of the arbitration which supplies the procedural legal framework. In addition the global enforcement regime supplied by the New York Convention (and also the ICSID Convention) makes arbitration a particularly effective dispute resolution mechanism where the parties have assets worldwide and against which the prevailing party may seek to enforce its award.

High-value disputes

Arbitration is also well suited for high-value disputes. Its confidential nature is appreciated by parties that want to attract minimal attention to their dispute that, given the sums involved, would inevitably be media fodder if played out in a public forum.

Thus, arbitration spawns big awards (deriving from even bigger claims). As Michael Goldhaber (a U.S. arbitration commentator) wrote when introducing the 2011 American Law Daily Arbitration Scorecard: “The Biggest Cases You Never Heard Of: A billion here, a billion there. Pretty soon, it adds up to a real justice system”.[23] That Scorecard identified 113 billion-dollar arbitration cases. Altogether, it identified 261 cases that fulfilled its criteria of being either: (i) an investment treaty case with at least US$100 million at stake; or (ii) a commercial arbitration with US$500 million at stake.[24]

One example of a recent high-value award includes the US$1.8 billion (US$2.3 billion including interest) recently awarded to Occidental Petroleum Corporation in an arbitration against Ecuador under the US-Ecuador investment treaty.[25] Even more breath-taking, in a series of arbitrations brought by the majority shareholders of Yukos Oil Company against Russia in relation to its expropriation of their investment, the Claimants’ counsel has publicly stated that the compensation sought exceeds US$ 114 billion. With numbers like this, arbitration can certainly lay claim to resolving disputes with significant financial stakes.

Disputes concerning issues of public policy

Arbitration as a suitable forum for resolving international and high-value disputes might, per se, enable it to pass the qualitative threshold. However, arbitration confirms its status as resolving important disputes when one considers its role in disputes concerning issues of public policy.

A fundamental premise of arbitration is that it does not impinge upon the rights of third parties. The consensual nature of the arbitration process means that third parties cannot be bound by an arbitration award. That is the consequence of it being a “privatised” system of law. However, it would be naïve to dismiss the broader implications of arbitration awards. In particular, the increasing use of arbitration for disputes involving States means that arbitral decisions can impact upon a population of millions. Moreover, there are strong arguments that the jurisprudence deriving from investor-State arbitration awards influences State behaviour.

Investor-State arbitration

By definition, any investment treaty award in favour of a claimant is a rebuke to the State that its conduct (irrespective of its domestic lawfulness) breaches its international law obligations as set out in the relevant investment treaty. The requirement that a State comply with its international law obligations, and the principle that domestic law cannot provide cover, are not new. However, the exponential growth of investment treaty arbitration has fundamentally changed the landscape for States. (The 48 arbitrations registered in 2012 with ICSID, the preeminent institution for administering investment treat arbitration, eclipsed the total number of arbitrations registered with ICSID between 1965 and 1995.)

Investment treaties are designed to afford comfort to foreign investors by providing them with direct recourse, through arbitration, against a State that breaches the treaties’ substantive protections. The protections generally include the requirements to afford a foreign investor fair and equitable treatment and full protection and security, and the prohibition of expropriation (unless conducted on a non-discriminatory basis and accompanied by suitable compensation). Often an investment treaty is a remedy for an underdeveloped domestic legal system.

However, it is highly unlikely that States, when entering into (certainly the earlier) investment treaties, envisaged that they would encroach upon their freedom to act within their domestic space to the extent that they have. Investors have become savvy at invoking investment treaties to protect their investments and tribunals have been willing to interpret the treaties expansively. Cases have been brought contesting various State actions, including taxation policy, environmental regulations and license allocations. Investment treaty arbitration has also been used to challenge States’ omissions, such as a State’s failure to afford adequate protection to an investment during periods of civil unrest and, even, its failure to provide sufficient regulatory oversight. For example, letters of notice (the precursor to an investment treaty claim) have been sent to the U.S. by foreign investors that were stung by U.S. financier’s Alan Stanford’s Ponzi scheme. The investors allege lax oversight by the U.S. SEC.[26]

Other, specific, examples of investment treaty claims include tobacco companies arguing that Australia’s plain packaging legislation for cigarettes amounts to an indirect of expropriation of intellectual property rights.[27] Perhaps more pertinent in the current economic climate is the reliance upon investment treaty protections to challenge States’ economic decisions. Argentina’s decision to devalue the peso amid its economic collapse in 2001 meant it was deluged by more than 30 claims for a staggering estimated sum of US$17 billion in claimed compensation. More recently, the restructuring of Greek sovereign debt and the actions of the Cypriot government (upon instruction from the European Central Bank) are both likely to generate investment treaty claims. Recent awards permitting multi-party investment treaty arbitrations akin to class actions are likely to incite further investment treaty claims.[28]

Thus, the advent of investment treaty arbitration has had an enormous impact on how States exercise their public authority. It has been argued that investment treaty jurisprudence reflects the emergence of an international administration law that regulates the conduct of States through a private adjudicative mechanism.[29] That, in contrast to commercial arbitration awards, many investment treaty awards are public has allowed the resulting jurisprudence to develop into a body of supranational law. That has expanded the sphere of influence of such awards not only to the parties to the dispute, or even to parties of future similar disputes, but arguably has more broadly influenced States’ conduct. Like commercial arbitration awards, there is no formal precedence value accorded to investment treaty awards. However, because there is a common vocabulary employed in investment treaties, certain concepts have become a term of art (e.g. “fair and equitable treatment”). Tribunals are understandably swayed by previous reasoned awards that have sought to define the scope and interpret the meaning of such concepts. Indeed, such an approach is to be commended as contributing to the certainty of the investment treaty arbitration process.

Hence, investor-State arbitrations, although relatively small in number, have an enormous impact on States and their populations (as well as being a source of a number of the higher value arbitration claims).

State-State arbitration

On the State-State front, arbitration has also recently been used to settle law of the sea disputes, including maritime delimitation (historically the preserve of the ICJ). UNCLOS identifies four dispute resolution mechanisms that States may choose to resolve disputes regarding the Convention.[30] Annex VII arbitration (so-called because of the Annex where the more detailed procedure is set out) is the default mechanism in the event that either: (i) a State has not selected its preferred dispute resolution mechanism; or (ii) the disputing parties have not chosen the same dispute resolution procedure.[31]

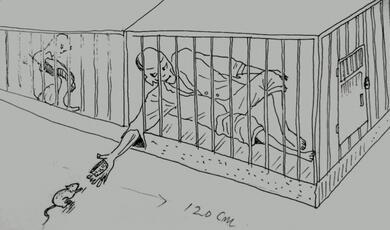

To date, Annex VII arbitration has predominantly been used in the context of maritime delimitation. The first Annex VII arbitral award was rendered in 2006 by the tribunal that resolved the maritime delimitation dispute between Barbados and Trinidad and Tobago with a boundary line (mostly) equidistant between them.[32] Barbadian fisherman that operated in Trinidad and Tobago’s claimed maritime area followed the arbitration carefully; the tribunal identified that the States should conclude an agreement to accord them access to fisheries within Trinidad and Tobago’s the Exclusive Economic Zone (though the tribunal itself declined to define a fisheries regime).

Thereafter an Annex VII arbitral award was rendered in Guyana v. Suriname in 2007, delimiting the States’ boundary with another (mostly) equidistant line. In that case, the parties were acutely aware of the valuable natural resources at stake; indeed a dispute over a drilling rig was the catalyst for the arbitration. The tribunal found that Suriname’s expulsion of a drilling rig was an unlawful threat of the use of force (though it declined to award compensation).

Currently there are four pending Annex VII arbitrations; Bangladesh v. India; Mauritius v. United Kingdom; Argentina v. Ghana; and, most recently initiated, Philippinesv. China. The latter is particularly noteworthy because China has resolutely declared that it has opted out of the UNCLOS compulsory dispute resolution mechanism and has thus far declined to participate in the proceedings. Nonetheless, the Philippines litany of requests (including a declaration that China’s maritime claims in the South China Sea are contrary to UNCLOS) directly challenge China’s maritime claims in the South China Sea. For anyone familiar with the South China Sea and the overlapping interests asserted by multiple States, it will be clear that the progress of this arbitration will be keenly followed by neighbouring States and hydrocarbon companies.

The Argentina v. Ghana arbitration also illustrates the relevance of Annex VII arbitrations to third parties. In that case, Argentina is seeking a declaration that Ghana’s actions in detaining the Argentinian warship Libertad were unlawful. The Ghanaian Commercial Court had ordered the detention after NML Capital, one of (a long list of) Argentina’s judgment creditors that has been chasing Argentina’s assets around the globe, filed suit as soon as the ship docked in Ghana asking for an injunction to seize the ship as partial repayment for the debt.

Closer to home, the Mauritius v. United Kingdom arbitrationwas initiated by Mauritius in an attempt finally to resolve the long-standing dispute regarding the Chagos Archipelago in the heart of the Indian Ocean. The tribunal has been asked to resolve title to the archipelago and determine the validity of the U.K. designation of a significant proportion of the area as a marine protected area.[33] This is another interesting example of an arbitral tribunal being tasked with determining matters of great political importance. As many here will recall, the House of Lords ruled that the native Chagossians were not entitled to return to the islands.[34] In discharging its mandate, the tribunal will need to address a number of important public international law issues including the validity of the 1965 Agreement between Mauritius and the United Kingdom whereby the latter effectively bought the archipelago and the Chagossians were resettled.[35]

The use of arbitration to settle State-State disputes relating to such a significant issue as maritime delimitation and the lawfulness of State conduct further demonstrates the role of arbitration in determining public policy issues.

Thus, given the nature of many disputes submitted to arbitration; the international focus, the high sums involved and the issues of public policy that are determined, it is obvious that arbitration passes the qualitative threshold necessary for arbitration to reach the next step of consideration as a World Court.

V. THE ARBITRATION ECO-SYSTEM

As previously explained, the arbitration eco-system has the potential to elevate arbitration from merely a popular and important, but nonetheless, patchwork dispute resolution mechanism to a system of law that resembles a World Court. For arbitration to be considered a World Court its eco-system should be legitimate, cohesive and autonomous. I will consider in turn the (i) international institutions that support arbitration; (ii) the transnational rules that provide the procedural framework; (iii) the pool of arbitrators that disputing parties rely on to determine their disputes; and (iv) the enforcement mechanism that underpins arbitration awards.

International institutions

There are a number of international institutions which administer arbitrations. Some of the older institutions date to the late nineteenth century.[36] However, the institutions in their modern guise appeared in the last fifty years. The relevance of these institutions to the question of whether arbitration has created a World Court primarily lies in their role of globally harmonising arbitration practice and expanding the geographical breadth of international arbitration.

The services offered by the institutions vary. In general, they provide a body of arbitration rules which provide a default structure to the proceedings. However, institutions may administer proceedings governed by other rules (most often under the UNCITRAL Arbitration Rules) for which there is no affiliated institution. I will consider the development of the institutions’ arbitration rules in due course.

The institution may also be involved in the tribunal appointment process, either at the request of the parties or in the event of a failure by a party to appoint an arbitrator. Additionally, the institutions’ personnel assist with practicalities (such as the arbitrators’ fees). Thus institutional arbitration releases counsel and arbitrators from dealing with many administrative issues. It also ensures that differences between the parties regarding such issues do not impede the progress of the arbitration. By fulfilling such administrative functions and providing procedural (not substantive) oversight, the institutions provide a structure to the proceedings that otherwise ad hoc arbitration can lack.

Although many of the institutions include a geographical component in their name (London Court of International Arbitration, Stockholm Chamber of Commerce, Hong Kong International Arbitration Centre) this is misleading. The LCIA now has outposts in New Delhi, Dubai and the Mauritius. The ICC lists offices in Paris and Hong Kong. The institutions’ names are merely a nod to the location of their headquarters. The international institutions do not confine their services to parties domiciled, or to disputes arising, in a particular jurisdiction. Nor do they mandate that the seat of the arbitration by aligned with the “home turf” of the institution. Indeed, any such limitations would be illogical, given that one of the key benefits of international arbitration is to provide the flexibility for international parties to resolve disputes outside of the forum conveniens.

The institutions are at pains to tout their international credentials. For example, the LCIA highlights that it will administer proceedings “regardless of location, and under any system of law” and boasts that “[t]ypically, more than 75% of the cases referred to the LCIA involve no UK parties at all.”[37] Likewise the ICC notes that in 2012 it received Requests for arbitration from parties in 137 countries and independent territories, the place of arbitration was located in 59 countries, and arbitrators of 76 nationalities were appointed or confirmed under the ICC Rules.[38]

The international outlook of the institutions is important because of the impact it has on the practice of arbitration. Although a London-based lawyer may sometimes advocate the LCIA and a Singaporean lawyer may be a proponent of SIAC, an arbitration lawyer’s website will boast of his/ her familiarity with an array of institutions. As such, arbitration has become fully internationalised. Parties and their counsel need not choose an institution based solely on geographical considerations.

Of course, having identified the role of institutions in providing structure to the practice of international arbitration, it is important to note that a number of arbitrations are conducted on an ad hoc basis and not administered by any institution at all. Nonetheless, one might claim that the institutions, in more generally developing the practice of arbitration, have enhanced the practice of ad hoc arbitration. Practitioners used to institutional arbitration are likely to adopt a similar administrative approach to ad hoc arbitration. In any event, institutional arbitration is the preferred choice for corporations and its popularity is on an upward trajectory. A 2006 survey of in-house counsel at leading corporations found that 76% of respondents generally opted for institutional arbitration. Two years later the same survey found that 86% of awards that were rendered over the previous ten years were institutional arbitrations.[39]

Thus arbitration is becoming more institutionalised and, as such, more cohesive. Of course, the multiplicity of institutions precludes international arbitration from being entirely standardised and no single institution dominates such that it could be, individually, crowned a World Court. However, the international reach of institutions means that arbitration is not regionally constrained. International arbitration can be considered cohesive insofar as all users are able to avail themselves of the services offered by any of the institutions. The various institutions should not be characterised as undermining the harmonisation of arbitration but enhancing the choices available to arbitration users. The institutions, per se, have not created a World Court but by supporting the structural development of arbitration they have promoted the cohesiveness of its eco-system.

Transnational rules

Procedural framework

A World Courtshould have a procedural framework. Therefore, to argue that international arbitration has de facto created a World Court, there should be transnational procedural rules that provide some consistency between arbitrations. Such rules provide the procedural predictability required in any defined legal system. Arbitrations operate under a two-tier procedural framework. The first tier is the procedural rules of the arbitration. The second tier is the relevant arbitration law of the seat of the arbitration.

The procedural rules of the arbitration are consensually adopted by the parties and supplemented by the tribunal’s orders, as required. The parties may specify in the arbitration agreement specific rules or adopt, wholesale, a ready-made package of rules supplied by an institution. The institutions’ rules are the CPR of the arbitration world; the key distinction being that they are invariably much shorter (I refrain from classifying this as either an advantage or a disadvantage).

The institutions’ rules can be an important factor when selecting the appropriate institution to administer proceedings. Therefore, the distinctions between institutions’ rules can be important. For example, ICC arbitrations are distinguished by the fact that the institution internally reviews the tribunal’s award prior to it being distributed to the parties. This reassures the parties that the award has been scrutinised but can sometimes slow down the process. Depending on the parties’ primary considerations it may be a reason for selecting or avoiding arbitration under the ICC Rules.

However, in general, there is a growing convergence between institutions’ rules. This is unsurprising. The institutions operate in a competitive market place and therefore all seek to accommodate the parties’ (and their counsels’) preferences. Moreover, each institution’s rules are generally developed by arbitration practitioners who have experience of conducting arbitrations under the various rules. They are therefore are well-placed to identify the best features of each and, as rules are revised and updated, amend to reflect best practice. Indeed, in some cases it is the same lawyers who are involved in the revision of multiple institutions’ rules.

The provisions for dealing with an urgent need to obtain interim relief prior to the constitution of the tribunal provide a perfect example.

In 2007 the International Institute for Conflict Prevention & Resolution revised its Rules for Non-Administered Arbitration of International Disputes to provide for “Interim Measures of Protection By a Special Arbitrator”.[40] Since 2009, when the International Centre for Dispute Resolution (the “ICDR”) adopted similar provisions in its Rules, other institutions and rule-making bodies have raced to follow suit and, after a wave of revisions, many procedural rules now contain what is termed “emergency arbitrator provisions”.[41] Until the beginning of this month the LCIA and HKIAC Rules were conspicuous in not having such provisions, but the Hong Kong International Arbitration Centre announced new rules on the 12th June which include emergency arbitrator provisions and the LCIA is expected to publish new rules soon. More generally, the institutions have similar rules regarding, inter alia, (i) respecting the parties’ autonomy to appoint arbitrators;[42] (ii) allowing a tribunal to determine its own jurisdiction;[43] (iii) respecting the confidentiality of the proceedings; (iv) affording the tribunal discretion to award legal costs; and (v) the imposition of nationality restrictions on a sole arbitrator or chairman.

In addition to the institutions’ general arbitration rules, there is a plethora of more specific rules which the parties or the tribunal may elect should apply. The IBA is particular noted for the publication of such materials. Its various Guidelines have sought to address the practical problems that arise with an international dispute resolution mechanism; viz. lawyers from different legal backgrounds may find themselves as opposing counsel in the same case with entirely different approaches to issues such as privilege, the admissibility of evidence, and disclosure. To ensure the fairness of the proceedings and equality of the parties it is imperative that there is a common understanding as to the appropriate conduct in international arbitration. The IBA’s materials reflect detailed consultation with leading practitioners from both civil and common law backgrounds in order to develop an approach that can be universally accepted.

Most prominent are the IBA Guidelines on Conflicts of Interest in International Arbitration (2004) and the IBA Guidelines for Taking of Evidence in International Arbitration (2010). The latter address the appropriate standard for disclosure, the deployment of fact and expert witnesses, and the admissibility and assessment of evidence. These are often adopted wholesale in an arbitration or otherwise specific elements are incorporated into the tribunal’s procedural orders. A 2012 study of international arbitration found that these rules were used in 60% of arbitrations (in 7% as binding rules and 53% as guidelines for the Tribunal and parties). An even larger percentage (85%) of survey respondents found the adoption of the IBA Guidelines useful; a remarkable level of consensus amongst lawyers.[44] Even where the IBA’s Guidelines are not expressly incorporated into the proceedings, it is likely that the counsel and arbitrators will refer to them when confronted with particular procedural issues for which they provide direction. Slowly norms are developed. Thus, it would be a brave prospective arbitrator that accepted an arbitral appointment in contravention of the IBA Guidelines on Conflicts of Interest. Were the contravention later to be revealed, it would form a persuasive case for removing the arbitrator with attendant consequences for both the arbitration and the arbitrator’s reputation.

Less formal, but equally pervasive, are concepts such as the Redfern Schedule (a variant of the Scott Schedule) that frequently finds its place in the disclosure process of many arbitrations.

Potentially undermining the concept of transnational procedural rules is that the seat of the arbitration to a certain extent localises the proceedings. The parties’ chosen seat determines the applicable arbitration law which, if required, is used to resolve key issues such as the grounds on which an arbitration award can be set aside and the circumstances in which an arbitrator can be removed. However, there are two important points to note.

First, like procedural rules, arbitration laws are becoming increasingly harmonised. This was noticed by the eminent Swiss academic and arbitration practitioner, Gabrielle Kaufmann-Kohler, a decade ago, although she acknowledged that it was a trend, rather than an achieved outcome.[45] The influence of the UNCITRAL Model Law must be recognized in this respect. This was ground-breaking in its efforts to harmonise disparate national arbitration legislation, so providing arbitration users with an even greater level of transnational consistency. Legislation based on the UNCITRAL Model Law has been enacted in 66 States, including States as diverse as Armenia, Australia, Chile, India , the Republic of Korea and Rwanda. By adopting legislations based on the Model Law, States that might otherwise not have been identified as arbitration-supportive jurisdictions are immediately afforded a level of legitimacy.

Second, parties choose the seat of their arbitration. There is no necessary connection between the seat and the underlying dispute or the geographical location where arbitral activities (such as any oral hearing) are carried out. The consequence is that a few key jurisdictions are most commonly identified as the seat of the arbitration. Favoured seats are London, New York, Washington D.C., Paris, Hong Kong, Singapore, Stockholm, Geneva and the Hague. Although their local law and attitude towards arbitration is not identical, all are generally noted as arbitration-supportive jurisdictions. The fact that parties are free to choose the seat means that although arbitration laws are not perfectly standardised, there is a cohesiveness insofar as arbitration users are all able to avail themselves of the arbitration law that they prefer.

The convergence of the institutions’ procedural rules, together with the increasing pervasiveness of other guidelines and practices and the harmonisation of national arbitration laws provides support for the notion that arbitration is moving towards the transnational procedural framework inherent in the concept of a World Court.

The pool of arbitrators

It is easy to misconceive the notion of a court as a physical place but it is pertinent to recall the Oxford English Dictionary definition of it as “a body of people presided over by a judge, judges, or magistrate, and acting as a tribunal in civil and criminal cases”. By extension, therefore, one would presume that a World Court should comprise a standing international judiciary.

Arbitration does not have a formalised standing body of arbitrators. Indeed, perhaps the key distinction with court proceedings is the source and manner of appointing an arbitral tribunal. It is common practice for the parties themselves to be directly involved in the appointment of a tribunal (e.g., a common process is for each party to appoint one arbitrator and then seek to agree the chairman or devolve that appointment to an institution).

One might, therefore, conclude that on this basis arbitration cannot be a World Court. This would be premature. On closer analysis, arbitration does have a body of lawyers akin to a standing judiciary. The various institutions generally have a roster of arbitrators that they use for the purpose of appointments devolved to the institution. Furthermore, in reality, there is a relatively small pool of arbitrators who determine the more important commercial and investment treaty arbitrations. Indeed, the emergence of an arbitrator elite (recently unflatteringly described as “gorillas”, and also “referred to as a ‘cartel’, a ‘club’ or a ‘mafia’”[46]) who dominates tribunals has been identified as problematic. It is a function of the party-appointment process under which parties seek to appoint big-name arbitrators whom they believe may hold views helpful to their position. Indeed, so small is the pool of arbitrators that, in some cases, they are repeat-appointed by the same firm. Only last week, an extremely eminent arbitrator survived a challenge to his appointment from a State complaining that he relied on repeat appointments by the law firm representing the party that had appointed him in that case.

In one respect the existence of this arbitrator elite, akin to a standing judiciary, lends weight to the claim that arbitration has developed into a World Court. However, naturally, a perennial issue for discussion is the legitimacy of arbitral tribunals appointed in this manner. Arbitrators are, in effect, judges for hire; dependent on their next appointment for their fees. It is disconcerting to recall the reported statistic that almost all dissenting opinions are written by an arbitrator nominated by the losing party.[47] Though, in general, the independence of arbitrators once engaged in a case is widely respected, the selection process can be highly strategic. As I expressed at the outset, the arbitration eco-system must be deemed legitimate for it to form the basis of a World Court. The arbitrator appointment process potentially undermines this requisite legitimacy. This legitimacy crisis is unlikely to be resolved soon as parties and counsel alike, though fully aware of the processes shortcomings, are protective of this perceived benefit of arbitration.

Global enforcement mechanism

Arbitration could not be considered an autonomous legal order were its awards unenforceable. The New York Convention ensures that arbitration awards are enforceable throughout its Member States with relatively little judicial oversight. This reflects States respect for international arbitration and the awards generated by the arbitral process.

In this respect, the New York Convention can be contrasted with the failed attempts in relation to an equivalent treaty regarding foreign judgments. The Hague Convention on the Recognition and Enforcement of Foreign Judgments in Civil and Commercial Matters was concluded in 1971 but has only entered into force for Albania, Cyprus, Kuwait, the Netherlands and Portugal.[48] There is a lingering suspicion of a foreign court that may have improperly seized jurisdiction and foreign judicial processes that might not be as impeachable as those enjoyed here. The diversity of legal and political traditions makes it difficult for judges to contemplate the enforcement of judgments deriving from legal principles alien to them. Though international arbitration awards may similarly apply different laws and procedures it generally circumvents such issues because of its consensual basis.

ICSID awards (i.e., awards handed down in arbitrations administered by ICSID pursuant to the ICSID Convention and Arbitration Rules) are enforced pursuant to the ICSID Convention, rather than the New York Convention. However, they similarly enjoy the benefit of being enforceable worldwide. The ICSID Convention provides that “Each Contracting State shall recognize an award rendered pursuant to this Convention as binding and enforce the pecuniary obligations imposed by that award within its territories as if it were a final judgment of a court in that State”.[49]

The very restrictive grounds for judicial oversight in the New York Convention and the absence of any provision for judicial oversight in the ICSID Convention strengthen the finality of arbitration awards and the autonomy of the arbitration process. Moreover these global enforcement mechanisms obviously promote the cohesiveness of the arbitration system; arbitral awards rendered by any tribunal seated in New York Convention States are treated alike, irrespective of the administering institution, arbitrators, procedural rules or other features that might otherwise distinguish them. Similarly, ICSID awards are all treated equivalently. Such mechanisms also increase the legitimacy of arbitration by ensuring that an arbitration award is, per se, valuable. Its strong global enforcement mechanism is crucial to arbitration’s claim to be a World Court.

VI. Conclusion

Taken as a whole, does international arbitration amount to a World Court? The developments I have identified go a long way to providing a “yes” answer. Even though the “single international institution” envisaged by Hans Smit has not materialised, the system we are now using provides, in fact and practice, much of what he wanted to achieve.

The increasing institutionalisation of arbitration, and the structure that provides, together with the growing convergence of the procedural framework within which arbitration operates has contributed to its increasing cohesiveness. The small pool of arbitrators (akin to a standing judiciary) likewise provides an important linkage between what otherwise could be a very disparate system. The global enforcement mechanism is fundamental to both promoting the cohesiveness of the system and its autonomy.

As the arbitration community continues to refine the system its legitimacy is enhanced. This legitimacy is reflected and reinforced by users increasingly electing to use arbitration as a means of resolving for international and significant disputes, hence the trends identified in my preliminary quantitative and qualitative analysis.

This process is not reversing, it’s continuing. Let me single out four possible future developments that, if they were to come to fruition, would advance the World Court idea:

First, the lack of a fully harmonised approach to the ethical standards that underpin any dispute resolution system must be addressed. Great progress has been made already in this respect. Thus, the Council of Bars and Law Societies of Europe (the “CCBE”) in their supra-national Code of Conduct for European Lawyers has sought to include specific provisions relating to international arbitration. Unfortunately, these do not go far enough and are too generic to guide practitioners as to appropriate conduct in specific situations. More recently, arbitration practitioner Doak Bishop at the ICCA Congress 2010, presented a draft Code of Ethics for Lawyers Practicing Before International Arbitral Tribunals.[50] He recognized that it was merely an imperfect starting point but he requested the arbitration community to consider such a code to “protect [the system’s] integrity and legitimacy”.[51] His request may have been answered. In 2008 the Arbitration Committee of the IBA established a Task Force on Counsel Ethics. In May 2013, that Task Force published the IBA Guidelines on Party Representation in International Arbitration. If these Guidelines are as successful as previous IBA initiatives then they should go a long way to addressing the current differing norms and practices of arbitration practitioners.

Second, to address the legitimacy concerns that arise from the current tribunal appointment process, it may evolve to resemble even more closely a standing judiciary. Leading arbitration figures Jan Paulsson and Albert Jan van den Berg have been vocal critics of the current party-appointment process. Jan Paulsson suggested that to avoid the “moral hazard” associated with party-appointed arbitrators, “any arbitrator … should be chosen jointly or selected by a neutral body” and further suggested that such appointments be made from a pre-existing list of qualified arbitrators.[52] The arbitrators on such a list would be virtually indistinguishable from a standing judiciary. Will parties and their counsel relinquish their cherished opportunity to select an arbitrator? The jury is out. Indeed, two other eminent arbitration practitioners were direct when defending the current process, with an article entitled “Why the Paulsson – van den Berg Presumption that Party-Appointed Arbitrators are Untrustworthy is Wrongheaded”.[53]

Third, the New York Convention may be updated to further harmonise the enforcement mechanism that it provides. I have already lauded the importance of the New York Convention. It deserves praise for its felicitous drafting which has meant that it has withstood fifty-five years without being updated. Nonetheless, Albert Jan van den Berg has presented a revised Draft Convention that, he posits, will better serve modern international arbitration.[54] For example, the New York Convention has been criticised because it includes a public policy exception based on the public policy of the country in which enforcement is sought.[55] This has created uncertainty and inconsistency because of the variance between States’ approaches. The Draft Convention specifically refers to “international public policy”.[56] However, again, this is within the arbitration community controversial. For example, in explaining why he considers that the New York Convention should be left alone, Emmanuel Gaillard identified “the ‘three NOs’: there is no need, no hope and no danger”.[57]

Fourth, to strengthen the autonomy and legitimacy of arbitration, a supra-national body to act as an appellate mechanism might be established. This would be the most radical development and would require an international treaty to establish the body. An appellate mechanism would provide oversight that would increase the accountability of tribunals and therefore improve the legitimacy of the process. This idea has been mooted in academic articles for many years.[58]

Whether or not these particular developments come to pass, I predict that the enthusiasm and energy of the arbitration community to create a global dispute resolution system means that, in five to ten years, a future speaker on this topic will be able to answer this question with an unqualified “yes; international arbitration has now created a World Court”.

© The Rt Hon The Lord Goldsmith QC 2013

[1] Sundaresh Menon SC, ‘International Arbitration: The Coming of a New Age for Asia (andElsewhere)’ (ICCA Congress, Singapore, 2012), para. 2.

[2] Sundaresh Menon SC, ‘International Arbitration: The Coming of a New Age for Asia (andElsewhere)’ (ICCA Congress, Singapore, 2012), para. 35.

[3] HM Courts are not totally devoid of commercial sensibilities. Court Fees are rising and HM Courts & Tribunal Service website advertises “Court venue hire for events, weddings and filming”. Indeed, the Royal Courts of Justice have provided a spectacular venue to the International Arbitration Ball in previous years.

[4] Often the arbitral institutions are non-profit organisations.

[5] Hans Smit, ‘The Future of International Commercial Arbitration: A Single Transnational Institution’ (1986-1987) 25 Columbia Journal of Transnational Law 9.

[6] Hans Smit, ‘The Future of International Commercial Arbitration: A Single Transnational Institution’ (1986-1987) 25 Columbia Journal of Transnational Law 9, 29.

[7] John Templeman, ‘Towards a Truly International Court of Arbitration’ (2013) 30 Journal of International Arbitration 197.

[8] K-H Ziegler, Das Private Schiedsgericht im Antiken Romischen Recht (1971), 199-201 cited in Gary Born, International Arbitration: Cases and Materials (2011), 12.

[9] Derek Roebuck, ‘A Short History of Arbitration’ in Hong Kong and China Arbitration: Cases and Materials (1994) xlii-xliv.

[10]Robert Briner, ‘Philosophy and objectives of the Convention’ (New York Convention Day, 10 June 1998), in Enforcing Arbitration Awards under the New York Convention: Experience and Prospects.

[11]See, <http://www.uncitral.org/uncitral/en/uncitral_texts/arbitration/NYConvention_status.html.>

[12]UNCTAD, World Investment Report 2012 – Toward a New Generation of Investment Policies 18.

[13]General Assembly Resolution 2205 (XXI), 17 December 1966.

[14]Emmanuel Gaillard, ‘International Arbitration as a Transnational System of Justice’ in Albert Jan van den Berg (ed.) Arbitration – The Next Fifty Years, 50th Anniversary Conference, Geneva 2011 (ICCA Congress Series No. 16, 2011) 69.

[15]Emmanuel Gaillard, ‘The Emerging System of International Arbitration: Defining “System”’, (2012) 106 American Society of International Law Proceedings, 287.

[16]Ministry of Justice, Judicial and Court Statistics 2011 (2012), 10. https://www.gov.uk/government/publications/judicial-and-court-statistics-annual

[17]Theodore Eisenberg and Geoffrey P. Miller, ‘The Flight From Arbitration: An Empirical Study of Ex Ante Arbitration Clauses In the Contracts of Publicly Held Companies’ (2007) 56 DePaul Law Review 335.

[18]Christopher R. Drahozal and Stephen J. Ware, ‘Why do Businesses Use (or Not Use) Arbitration Clauses’ (2008) 25 Ohio State Journal on Dispute Resolution 433.

[19]Jan Paulsson, ‘Arbitration Without Privity’ (1995) 10 ICSID Review – Foreign Investment Law Journal 232, 234.

[20]Tradex Hellas S.A. v. Republic of Albania (ICSID Case No. ARB/94/2), Decision on Jurisdiction, 24 December 1996; Zhinvali Development Ltd v. Republic of Georgia (ICSID Case No. ARB/00/1), Award, 24 January 2003; Inceysa Vallisoletana S.L. v. El Salvador (ICSID Case No. AB/03/26), Award, 2 August 2006.

[21]For an explanation of how this works see the decision of the Caribbean Court of Justice handed down this week, British Caribbean Bank Ltd. V. The Attorney General of Belize [2013] CCJ 4 (AJ).

[22]Gary Born, ‘A New Generation of International Adjudication’ (2012) 61 Duke Law Journal 775.

[23]Michael Goldhaber, ‘Arbitration Scorecard 2011: The Biggest Cass You Never Heard Of” The American Lawyer (6 July 2011).

[24]Ibid.

[25]Occidental Petroleum Corporation and Occidental Exploration and Production Company v. Republic of Ecuador (ICSID Case No. ARB/06/11), Award, 5 October 2012.

[26]Luke Eric Peterson, ‘Victims of Stanford Ponzi Scheme Threaten to Arbitrate vs. United States Under Trade and Investment Treaties, Investment Arbitration Reporter (19 March 2013) < http://www.iareporter.com/articles/20130319_1>

[27]Phillip Morris Asia Ltd v. Australia (UNCITRAL, PCA Case No. 2012-12).

[28]Abaclat and Others v. Argentine Republic(ICSID Case No. ARB/07/5), Decision on Jurisdiction and Admissibility,4 August 2011.

[29]Benedict Kingsbuy and Stephan Schill,‘Investor-State Arbitration as Governance: Fair and Equitable Treatment, Proportionality and the Emerging Global Administrative law’ Justice’ in Albert Jan van den Berg (ed.) 50 Years of the New York Convention (ICCA Congress Series No. 14, 2009) 151; Gus Van Harten and Martin Loughlin, ‘Investment Treaty Arbitration as a Species of Global Administrative Law’ (2006) 17 European Journal of International Law 121.

[30]Article 287 of UNCLOS. Pursuant to Article 298 of UNCLOS States may declare that it does not accept the dispute resolution procedures with respect to various categories of disputes, including delimitation.

[31]There is also Annex VIII “special” arbitration for the determination of disputes relating to specific subject-matter.

[32]Two previous Annex VII arbitrations, Malaysia v. Singapore and Ireland v. the United Kingdom (“MOX Plant Case”) were instituted but terminated.

[33]Mauritius was incited to launch the arbitration by a leaked document on Wikileaks suggesting that the United Kingdom had designated the marine protected area for strategic rather than environmental reasons.

[34]R (Bancoult ) v. Secretary of State for Foreign and Commonwealth Affairs [2008] UKHL 61. The U.S. Courts haveheard related litigation, dismissing the Chagossian’s challenge under the Alien Tort Claims Act to the decision to establish Diego Garcia as a U.S. military base and remove the Chagossians as a non-reviewable political question because it directly involved national security and foreign policy. (See Bancoult v. McNamara, 445 F.3d 427 (D.C. Cir. 2006), cert.denied, 549 U.S. 1166 (2007))

[35]Peter Prows, ‘Mauritius Brings UNCLOS Arbitration Against the United Kingdom Over the Chagos Archipelago’, (2011) 15 American Society of International Law Insights.

[36]The LCIA was inaugurated on 23 November 1892 and initially named the “City of London Chamber of Arbitration”. The Permanent Court of Arbitration was established in 1899.

[37]See, <http://www.lcia.org/Frequently_Asked_Questions.aspx#Non-English>.

[38]See, <http://www.iccwbo.org/Products-and-Services/Arbitration-and-ADR/Arbitration/Introduction-to-ICC-Arbitration/Statistics>.

[39]Queen Mary University of London and PriceWaterhouseCoopers, ‘International arbitration: Corporate attitudes and practices 2006’, 12; Queen Mary University of London and PriceWaterhouseCoopers, ‘International arbitration: Corporate attitudes and practices 2008’, 4.

[40]CPR Rules for Non-Administered Arbitration of International Disputes, Article 14. The much earlier 1990 ICC Pre-Arbitral Reference Procedure provided for a similar mechanism. However, this was not incorporated in the main ICC Rules and therefore required the parties expressly to opt-in.

[41]See, 2012 ICC Rules, Article 29 and Appendix V; 2010 SCC Rules, Article 32 and Appendix II, 2012 Swiss Rules, Article 43; and 2010 SIAC Rules.

[42]The LCIA Rules technically provide that the appointment is made by the LCIA Court “with due regard for any particular method or criteria of selection agreed in writing by the parties” (Article 5(5)).

[43]The SCC Rules are an exception. For arbitrations governed by the SCC Rules, the SCC Board shall determine whether the SCC has jurisdiction (Articles 9 and 10).

[44]Queen Mary University of London and White & Case, ‘2012 International Arbitration Survey: Current and Preferred Practices in the Arbitral Process’, 11.

[45]Gabrielle Kaufmann-Kohler, ‘Globalization of Arbitral Procedure’(2003) 26 Vanderbilt Journal of Transnational Law 1313, 1320.

[46]Catherine Rogers, ‘The Vocation of the International Arbitrator’ (2004-2005) 20 American University International Law Review 957.

[47]Alan Redfern, ‘Dissenting Opinions in International Commercial Arbitration: the Good, the Bad and the Ugly’ (2004) 20 Arbitration International 223; Albert Jan van den Berg, ‘Dissenting Opinions by Party-Appointed Arbitrators in Investment Arbitration’ in Majnoush Arsanjani et al. (Eds.), Looking to the Future: Essays on International Law in Honor of W. Michael Reisman, 824.

[48]See, <http://www.hcch.net/index_en.php?act=conventions.status&cid=78>.

[49]Article 54(1) of the ICSID Convention.

[50]Doak Bishop, ‘Ethics in International Arbitration’ in Albert Jan van den Berg (ed.) Arbitration Advocacy in Changing Times (ICCA Congress Series No. 15, 2010), 383.

[51]Doak Bishop, ‘Ethics in International Arbitration’ in Albert Jan van den Berg (ed.) Arbitration Advocacy in Changing Times (ICCA Congress Series No. 15, 2010), 383.

[52]Jan Paulsson, ‘Moral Hazard in International Dispute Resolution’, (2011) 8 Transnational Dispute Management.

[53]Charles Brower and Charles B. Rosenberg, ‘The Death of the Two-Headed Nightingale: Why the Paulsson-van den Berg Presumption that Party-Appointed Arbitrators are Untrustworthy is Wrongheaded’, (2013) 29 Arbitration International 7.

[54]Albert Jan van den Berg, ‘Hypothetical Draft Convention on the International Enforcement of Arbitration Agreements and Awards: Explanatory Note’.

See, <http://www.newyorkconvention.org/draft-convention> for: (i) a full text of the draft convention, (ii) a comparison of the Draft Convention with the New York Convention; and (iii) Explanatory Note.

[55]New York Convention, Article V(2)(b).

[56]Draft Convention, Article 5(3)(h).

[57]Emmanuel Gaillard, ‘The Urgency of Not Revising the New York Convention’ in Albert Jan van den Berg (ed), 50 Years of the New York Convention (ICCA Congress Series No. 14, 2009), 689.

[58]M. Rubino-Sammartano, ‘An International Arbitral Court of Appeal as an Alternative to Long Attacks and Recognition’(1989) 6 Journal of International Arbitration 181.

Part of:

This event was on Thu, 27 Jun 2013

Support Gresham

Gresham College has offered an outstanding education to the public free of charge for over 400 years. Today, Gresham College plays an important role in fostering a love of learning and a greater understanding of ourselves and the world around us. Your donation will help to widen our reach and to broaden our audience, allowing more people to benefit from a high-quality education from some of the brightest minds.

Login

Login