Trust in Markets?

Share

- Details

- Text

- Audio

- Downloads

- Extra Reading

In this lecture we shall concentrate on the issue of the extent to which markets at least implicitly depend on collective values such as trust and civic virtue. Such values are very difficult to analyse and justify in terms of purely rational economic man (sic) models of human motivation and ideas about values being wholly subjective. Are there ways in which features such as trust can be understood in ways which are wholly compatible with markets? So for example, can brands and brand franchises be seen as ways of creating trust in a way wholly compatible with markets? Equally can game theory provide a plausible way of modelling collective agreements as a basis for something like civic virtue in a way that is wholly compatible with market individualism?

This is a part of the lecture series, Religion and Values in a Liberal State.

The other lectures in this series include the following:

Markets in their Place: Moral Values and the Limits of Markets

Markets, Freedom and Choice

Just Markets

Selling Yourself Short: The Body, Property and Markets

What's it Worth? Values, Choice and Commodification

Download Text

14 May 2013

Trust in Markets?

Professor The Lord Plant

The issue of trust is pervasive in market relationships. This was borne out in the Weakley Report on the manipulation of the Libor rate but the problem of trust does not only depend on issues at the technical end of market behaviour and market relationships. Virtually everything in a market presupposes trust. The most pervasive in fact is trust in currency.

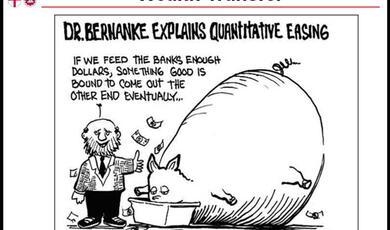

Once the connection between currency and a physical good like gold is severed then the value of currency does depend crucially upon trust and when currencies are allowed to float or for that matter when a government says that it will defend an exchange rate which it then finds it cannot then trust is eroded. Trust is crucial to the making of contracts. The great French sociologist Durkheim argued that not everything in the contract is contractual. By this he meant that contract depends upon a moral order of trust, of truth telling and promise keeping. Also at the level of the imp[lamentation of a contract for a very complex good like a new building there will have to be a good deal of discussion involving give and take and this process involves mutual\l confidence and trust. If these are eroded and themselves turned into a matter of choice and negotiation then the contractual relationship which depends on these things will also be eroded. This is the great danger in moral relativism, moral subjectivism and treating values in a wholly instrumental way. While it may be true that the market gives free rein to individualism and subjectivism in terms of the goods to be bought and sold nevertheless such transactions depend upon a whole network of values which once eroded are very difficult or impossible to reinstate. The same point holds true in terms of, the assessment of goods when the buyer and the seller stand in an asymmetrical relationship in regard information about a particular good to be trade between them. Relatively few goods now are what might be called inspection goods where the buyer can make his or her own assessment about the good in question. On the contrary complex goods will require the buyer frequently to rely on information and evaluation given by the seller. Electronic equipment would be a good example of this. Relatively few people are in a position to test and to challenge the information given by the seller. There are ways of checking using independent evaluations such as those in Which, for example, but by and large in our everyday transactions we more and more have to trust the seller of the goods in question This marks the difference between inspection goods and credence goods. With inspection goods like an avocado or a melon I can make my own judgement about the good in question; a credence good on the other hand has to be based on trust to a very large degree and that in turn assumes that the seller is not lying or manipulating me. A parallel issue here arises in relation to making activities with a firm in the market accountable to those who have a right to know whether it be an individual owner or share holders. During the financial crisis it became clear that quite a lot of people in senior positions in banks, finance houses and credit rating agencies had very little understanding of the rather abstract derivative goods bought and sold by these firms. In the case of consolidated debt obligations they were also a long way from what one might regard as a normal way to create a market price. In such circumstances senior figures in a firm and shareholders had to rely on the truthfulness and the trust worthiness of those doing the trading. If, however, they are motivated by the rational calculation of personal utility then there might be every reason to shield as far as possible the trading positions being taken up from those either within the firm or outside it fro scrutiny and accountability. If we operate with the standard capitalist behavioural assumption of belief in rational economic man or woman that is to say that the rational economic actor acts to maximise his or her utilities or self interest then we have to assume that this will be true also of trading in markets and when this is linked to large bonuses it seems to provide a reinforcement to rational economic or self interested behaviour which may well mean taking very severe risks.

The central difficulty here though goes back to my very first lecture in this series. Liberal capitalism has typically seen all value as residing in individual choice over the widest possible area. Given this approach there is not much scope for a defence of some objective or at the very least consensual values to underpin the market and indeed the role of the state within which the market operates. In the first lecture I argued for the indispensability of a conception of virtue which would play the same role in markets as civic virtues does in citizenship. That is to say the recognition that some values and some ways of behaving are required as a background set of conditions to enable us to exercise choice whether in politics and markets. To pick up a point from the end of my last lecture such values are in the technical sense public goods. You can’t produce them on your own, they require cooperation and yet you cannot exclude the non compliant. Because of this public goods will never be produced by a market and have to rely on some king of agreed moral sense across society.

So if we see the problem here the issue is how are we to proceed? There are perhaps two alternatives. The first is to identify and bolster those parts of society which rely on these public values. The other is to investigate whether markets themselves can be seen to be able to generate such a set of goods. One convenient way of referring to such goods is the terms social capital. Social capital goods among other things facilitate the shared practice to which they are relevant. So do these stand outside the market and provide a foundation for market transactions to operate in a reasonable way or can social capital be generated by markets themselves? If markets are fundamentally about individual choice and individual calculation of utility how can they in fact create a framework of social values?

Let us take the first option initially. The point here goes like this. Capitalism arose out of a strong religious background and strong communal bonds. The Judaeo- Christian tradition and a social order which relied crucially on personal contact provided a moral framework and moral sanctions within that framework to constrain the operation of markets and wholly selfish forms of motivation The problem though is that liberal forms of capitalism in fact undermine this ethical underpinning of the market order by reducing value to a matter of individual choice and to be seen as another instrumental matter in society. Yet the fact is that we cannot manage without this moral framework not least in markets. In his book Trust: The Social Virtues and the Creation of Prosperity Francis Fukuyama argues as follows:

...If the institutions of democracy and capitalism are to work, they must coexist with certain pre-modern cultural habits that ensure their proper functioning. Law, contract and economic rationality provide a necessary but not sufficient basis for the prosperity of post industrial societies; they must be leavened with reciprocity, moral obligation, duty towards community and trust which are based on habit rather than on rational calculation.

Markets cannot flourish without these things but liberal capitalism with its endorsement of rational economic man who acts in pursuit of his/her utility is constantly in the process of undermining precisely the moral framework which is essential to it- a point made decades ago by Karl Polyani in his book The Great Transformation and by Schumpeter in Capitalism Socialism and Democracy. In the Communist Manifesto Marx and Engels famously wrote that in capitalism all that is solid melts into air and the point of that in the modern context is that in so far as capitalism undermines and displaces traditional values and understandings then capitalism may well be undermining the moral order on which capitalism itself depends and which it cannot replenish or recreate.

Those who adopt this view will also point to the social consequences of capitalism and particularly very rapid social mobility so that people do not live in communities and neighbourhoods which could nurture a sense of common values and common culture but now are seen as individuals living more and more anonymous lives. The prescient philosopher Jeremy Bentham saw all of this at the beginning of the 19th Century when he argued that the most basic question for a society in which the bonds of common moral habits had been undermined by economic change was Who are you and with whom do I deal? I cannot any longer make any assumptions in an individualised society that I can rely on a common moral sense. Face to face relationships which both require and foster trust and mutual confidence have been eroded in favour of more abstract and thin types of relationships often achieved through electronic media.

Fukuyama talks about habits but the defender of liberal capitalism will argue that in place of habits we have to look to the law and to regulation to ensure compliance with those social norms which are central to the operation of markets. We have to have forms of regulation which take account of the self interested motivation of rational economic man not just decry the fact that traditional habits have been fatally undermined. There can for example be harsh sanctions for non compliance with contractual obligations and there could be rigorous anti monopoly legislation to preserve the framework of the market order. In a sense what is at stake here is the difference between a market economy and a market society. The cultural critics of capitalism are arguing that the extension of capitalist and market based accounts of motivation across society and not just within the economy will in fact destroy what capitalism depends on . The solution to this is to block the extension of markets to what such critics see as being inappropriate areas. This point relates to the lecture that I gave earlier about the extension of the idea of commodities beyond an appropriate limit. If more or less anything can be regarded as a commodity then we are well on the road to transforming society into a market society. This would however in the view of such critics be a very bad thing for the market order itself for the reasons that I have advanced on behalf of the critics of this view. A market society would certainly entail that in those areas of society becoming colonised by market relationships this will mean that ideas about self interest, the subjectivity of value, and the idea that rationality is purely calculative will become more and more dominant.

There are other arguments at stake here too. The first is that the legal regulation of what might otherwise be protected by an habitual normative order is very likely to be much more costly that an habitual order. If my word is my bond and a handshake seals a deal then this is going to cost a lot less than a regulatory framework. It is however difficult to see with social changes of the sort described above and the distancing effect of technological change such as computer based trading and indeed automatic trading can in fact be constrained by normative habits. In earlier phases of capitalist development when these normative habits may have seemed to be more salient there would have been a clear presumption that individuals would have to take responsibility or have responsibility assigned to them for breaches of these normative requirements. However this is hardly the case any longer large scale and fantastically costly failures may take place without anyone taking responsibility or being assigned responsibility for them. There is no doubt that modern computerised models of trading can make responsibility very difficult to assign. Robert Harris’ novel The Fear Index is quite a good example of this.

There is however a deeper point here. It is this that the legal and regulatory framework does not and cannot exist in a vacuum. It has to be supported by shared normative attitudes if such a framework is going to have purchase in society. On this view of the matter there can be no way in which the issue of shared norms and the goods of social capital can be avoided. If this is so we are back with our initial question is if shared norms are necessary for a capitalist economy and market to work properly how do we arrive at collective social norms from a wholly subjectivist point of view?

So in Fukuyama’s view we have to be very wary indeed about eroding trust by extending markets into other areas of society because trust is essential to markets but is eroded by them particularly in their modern more abstract form. So what would this mean in practice?

Let us take the role of the public sector. In this context we very often hear reference to the public service ethic and such an ethic implicitly implies a concern with trust. So how does this work? In the public sector very large budgets are involved in the absence of the possibility of bankruptcy what is it that constrains and disciplines the behaviour of public sector providers of service? The answer has traditionally been that it is the public service ethic or ethos coupled sometimes with the idea that work in the public sector shares some features with the idea of vocation. On the basis of the Fukuyama hypothesis about the role of trust in society we ought to be extremely wary of disturbing this sort of public service ethic because it provides precisely that sense of mutual trust which is essential to society. To turn these forms of service delivery into a market driven system that is to say to move from a market economy to a market society is dangerous because values of trust have to be diffused within society and the public services are used one way or another by virtually everyone. They have to trust the probity of service providers and the confidence that they might have in these providers might well rest upon the view that they are guided by a public service ethic.

Connected to this is the idea that in many areas at least of the public sector professional organisations play a part in regulating the behaviour and instilling a professional ethic and ethos among practitioners. The best example would be the General Medical Council and the General Nursing Council. At the moment the Government is contemplating a similar kind of body for teachers. So again professional ethics would be a non market mechanism for keeping providers of service up to standard. This is particularly important in medicine because very often the patient will not have the knowledge that his or her doctor has about the diagnosis, treatment and prognosis of the condition so the patient puts him or herself in the hands of the doctor and has confidence to do this because there is an ethical framework around the relationship which is designed to give the public and patients confidence in the services the doctors are providing. Trust and confidence overcomes the asymmetry of information and power between the doctor and patient, and between nurse and patient.

However very many defenders of the market order strongly dispute this and seek to expose the public service ethic as an illusion. Nigel Lawson argued in the 1980’s that people who work in the public sector are stepping into a different ethical realm such as that postulated in the idea of a public service ethic or ethos. In doing this he was drawing from the work of the Public Choice Theorists particularly the work of James Buchanan, Gordon Tullock and Niskanen who have devised economic explanations of bureaucratic and public sector behaviour. The fundamental idea in Fact goes back to the writings of the Scottish philosopher David Hume and in particular his essay On the Independency of Parliament in which he argues as follows:

“In contriving any system of government, and fixing the several checks and controls of the constitution, everyman ought to be supposed a knave and to have no other ends in all his actions than private interest. By this interest we must govern him and, by means of it, notwithstanding his insatiable avarice and ambition, co-operate to the public good”

On this view human nature is subject to the same motivation whatever its context. We seek to maximise our self interest in markets certainly but in other spheres also and that this is too powerful a force to be constrained and directed by an ethical framework like the public service ethic. We have to see this as an illusion and it is an insidious illusion because it causes us to look away from the real sources of motivation and thus the mechanisms which, unlike the public service ethic, would be appropriate for constraining the effect of self interest. We shall do this only if we recognise that every man and woman in the public realm is a knave and out to maximise self interest. We can contrast this as Julian Le Grand has done in his book Motivation, Agency and Public Policy with the knight. The public service ethic presents us with professions in the public sector seen as knights whom we can trust whereas they are self interested . It is only by recognising and harnessing that self interest that we shall be able to make self interested behaviour serve the public good.

So how, on public choice theoretical assumptions, does self interest work through into the organisation and delivery of public service. We have first of all to recognise that typically in conventional public service there is no threat of bankruptcy which is one of the major constraints on self interest in markets . It is in my self interest as the provider of goods in a market to serve my customers well otherwise I shall run the risk of bankruptcy which is an ever present threat. So bankruptcy has played an essential role in diverting self interest towards public benefits but this can only work in a market and not to have recourse to bankruptcy in markets will create moral hazard (as indeed Sir Mervyn King argued about one of the possible side effects of the bank bail outs). But as I have said in the public sector there is no possibility of bankruptcy and even where it has looked likely the government has stepped in to arrange mergers of services or take- overs or relaunches. This means that we have self interest operating outside of what public choice theorists regard as the chief constraint on self interested behaviour. So if there is no public sector ethic and if there is no bankruptcy then self interest has a pretty free rein. This will manifest itself in all sorts of ways. For example self interest in bureaucratically organised services is likely to work to expand those services and the size of the bureaucracy. Such growth will increase prestige, remuneration and power all of which are aspects of self interest. In such a context there is also little incentive to search for efficiencies in service delivery. Indeed the opposite may well be the case in that the more bloated the bureaucracy becomes the more it will enhance the prestige and self interest of those managing the service in question. Also in the context of welfare services self interested behaviour is likely to mean that there will be a search for the opportunity to exercise discretionary power as well as shielding the exercise of that power from say elected officials who might be attempting to make that power accountable. Both the provider of the service and the person(s) charged with making that power accountable are driven by self interest and in all likelihood the person providing the service has a stronger motivation to evade full accountability than the elected official whose motivation is likely to be lower because he or she has many different concerns to attend to and who in any case is unlikely to have the technical knowledge to evaluate how professional power is being discharged.

So, if self interest derives those in the public service as it drives those in markets the key is to ensure that this self interest is focused on the public benefit even though the ultimate sanction of bankruptcy is not available. There are many ways in which this might be done – not all of them compatible. I shall just run through some of these very quickly since what I want to concentrate on is what is at stake between a Humean view of motivation in which the idea of service is an illusion and on the other hand the public service perspective which sees its own ethic as creating the proper conditions of exercising power and expertise outside a market context.

Obviously the most clearest solution to the Humean problem is for the state to withdraw from both funding and providing public services and leave these to market mechanisms and/or private charity. This is the sort of proposal made by Robert Nozick the Harvard political philosopher and Charles Murray the US welfare policy scholar whose work particularly on the so called underclass has been much discussed in the UK. However this is such a radical scheme the solution is going to be far more costly and not just in financial terms than the problem that the solution is designed to solve. Another alternative is to try to tie down the delivery of public service either to targets and/or the empowerment of the client or the patient of the services. Targets mean that the delivery of the service is still in the hands of the provider but the way the service is delivered is no longer in the hands of the provider. If the target represents the best way of meeting the goals of the service then in adhering to the target the service is brought more fully into line with the needs of the clients and patients. This in turn can be liked to self interest by making the achievement of the targets a reason for paying bonuses or other kinds of addition to salary. The other possibility of the same sort is to empower the individual consumer of the service by incorporating the targets into what were called citizens charters so that the individual citizen knows what standard the service is supposed to attain and to hold the service individually accountable to this standard. Finally, and this comes quite close to what the government is currently doing is to pursue the funder/provider split. The idea here is that government funds a particular service and then businesses whether for profit or not and voluntary sector bodies can compete for contracts from the government to provide the services in question. So the provider then has to compete with other bidders for the contract and that competition will increase efficiency and also if they do not deliver the service properly or if they have rashly undercut budgets in order to win the contract they can go bankrupt.

The main point however is that this whole approach sees the public service ethic as a fig leaf for what are essentially producer interest groups and that the solution to the problem which this poses is to forget the service ethic and move the organisation of services to markets or into quasi markets. This would mean treating the providers as potential knaves as with Hume and devising ways, preferably of a market variety in order to take precautions against knavish behaviour. What is certain on this view is that there is no sector of society where the alternative vision of knights predominates as in the assumption of the public service ethic.

So what are we to make of this?

The first thing to point out is that from a Christian perspective the public choice approach offers a very bleak picture of human motivation and the need to reshape society to take full account of this because this view of human nature is the one embraced in the economic and financial markets. The present proposals which I have been indicating means that the market model, market assumptions about motivation, about the nature of value and so forth will predominate in society and rather than just a market economy we shall have a market society. On the view that we have been discussing it is argued that there is no great need for trust since appropriate behaviour is engineered either directly through financial incentives or indirectly through quasi markets and the producer/ funder split and by regulation.

Some defenders of the market model in this context want to argue that the Fukuyama thesis overstates the need for the market order for trust. This point is argued by Mark Pennington and James Meadowcroft in their IEA pamphlet Rescuing Social Capital from Social Democracy. They argue two important points. The first is that if we look at the ideal market liberal order namely a free market operating widely across society and not just in the economic sphere together with limited government then in fact the amount of trust and social capital needed is very different from what is needed in a more social democratic order where an extensive stste directly providing monopoly services would need to trade to a much greater extent on social capital than would be needed in a market society and a small state if as they argue the public service ethic is otiose. They point out quite rightly that social capital can be of two very different sorts. The first is bonding social capital that is to say a set of shared norms that define or constitute a specific social practice. Such practices may be of all sorts: voluntary organisations, churches, unions, professional organisations and so forth. Such groups are bound together by shared norms and a shared ethos. However such groups and their values may not be all compatible with one another. Cultural, ethnically derived and religious forms of social capital may create cohesive groups with a good deal lof bonding between them but such groups may be rejected by others and possibly a majority in wider society. Thus the pursuit of bonding social capital may be socially disruptive and we need some kind of benchmark for trying to determine whether or not particular forms of social capital are acceptable or not. So for example the ethos of the medical profession may sometimes work against the public interest as may many of the other groups with a strong ethos.

The other alternative is bridging social capital. They argue that this other form of trust based social capital may well be necessary for what we might call the capitalist state but it will be quite minimal. All we need is a form of thin bridging social capital which will provide the basis for normative agreement about the limits of government and the market order. They argue that we have to take this view because if Fukuyama’as view is correct then there is no solution. If to quote Fukuyama again pre-modern moral habits are necessary to the operation of capitalism then these are being eroded before our eyes, We need rather the most minimal social capital or agreement about values that we can manage .

This also links to their claim that contrary to the commonly held view the market can in fact create and generate its own forms of social capital. Their argument is that it does this through branding with franchising being rather like bridging social capital. People can trust and feel loyalty to brands or to goods which are franchises of established brands without in some sense having to appeal to some kind of antecedent and maybe pre-modern moral order which will include religion. The goods in question do not have to be simple goods but very complex credence goods: computer makes and types (Apple?) ; universities (many UK universities have now franchised campuses around the world as well as standard brands like Cadburys, Marks and Spencer, Lewis’s and so forth. So on this view the market can promote its own forms of trust and loyalty

© Professor the Lord Plant 2013

This event was on Tue, 14 May 2013

Support Gresham

Gresham College has offered an outstanding education to the public free of charge for over 400 years. Today, Gresham College plays an important role in fostering a love of learning and a greater understanding of ourselves and the world around us. Your donation will help to widen our reach and to broaden our audience, allowing more people to benefit from a high-quality education from some of the brightest minds.

Login

Login