The Universal Value of Nature

Share

- Details

- Transcript

- Audio

- Downloads

- Extra Reading

Does nature have a universal value? Can we consider natural capital as equivalent to financial capital? This lecture gives a brief history of value, exploring the similarities between historical arguments as to why the value of housework and nature are not reflected either in theory or in the system of national accounts and GDP. It will explore the difficulties with putting a value on nature, for example trying to make meaningful estimates of what contribution water makes to our lives.

Download Transcript

Does Nature Have a Universal Value?

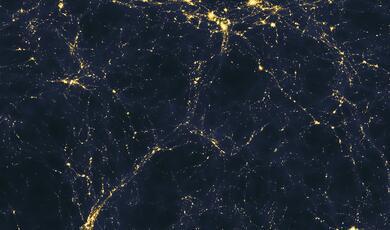

This fundamental question comes at a time when we are facing enormous losses of biodiversity and ecosystems and a possible sixth extinction and relying on nature-based solutions to tackle climate change and reductions of carbon in the atmosphere.

Actions to halt biodiversity loss and reduce emissions requires actions by us all. But as Sir John Harman, a former local councillor and Chair of the Environment Agency, said in his Fabian Society pamphlet The Green Crunch, an ecologically intelligent world cannot be smuggled past the electorate - it will need their support; and to get that will require more than the rationale being offered today - that we need to take action over carbon and nature because if we do not things will only get worse. What are needed instead are principles of action and a language to bring them to life; it could be about stewardship, valuing the earth, living in balance with nature, solidarity, or care for the future. These need to be part of what drives people’s choices and within practical reach.

When I began my thinking about this series of lectures on Natural Prosperity, I was seated in my mud house in the Maasai village of Ewangan looking over the Rift Valley. As the sun set over the wide horizon of the savanna, I could hear the sounds of millions of wildebeest, zebra and buffalo on their annual migration across the Maasai Mara. Hyenas were creeping nearer to the village attracted by the cattle, sheep and goats settling down inside the village. Elephants were moving in the forest and migrating birds circling in the red skies above. At my feet were two hunting Maasai dogs who had taken to life as my guards, although sadly both were killed in the line of duty - Cobella by a pack of other dogs and Simba Junior fighting off a lion.

I realised how deeply the intensity of the savannah flora and fauna had become engrained in my consciousness and what it meant alongside the textures and shades of my native British countryside and coasts, with me since childhood, and the open expanse of the oceans and Arctic of earlier explorations. And I could see that the Maasai themselves, along with many indigenous peoples, had an inbuilt logic to their lives based on the patterns of scarcity and abundance of resources around them – with no need for a separate economic logic. This was contrary to what Herman Daly had observed in industrialised societies with their economic logic of maximising returns to and investment in produced capital rather than nature.

It made me think of the struggles I was observing amongst conservationists and ecological economists to get mainstream thinking to move away from GDP, but which in the end is more about behaviours and norms.

I started considering the evolution of value and values in mainstream thinking about our current industrialised economies, and what I could see was a growing gap between private and social values, widespread frailties in human decision-making and a drift from moral to market sentiments. All three present real barriers to ensuring that our dependency on nature is properly reflected in our economies. Unfortunately, John Hobson in Wealth ad Life was correct in his analysis of consumption, when he observed that an industrial economy has a built-in bias towards excessive production and consumption of economic goods. Richard Tawney’s controversial book from the 1920s The Acquisition Society, goes further by saying that what society needs is a purpose, a principle of limitation that divides what is worth doing from what is not and settles the scale at which what is worth doing ought to be done and where economic activity is the servant not the master of society. Herman Daly expounded on this to consider an optimal scale for an aggregate economy relative to nature.

The example that jumped out of my surroundings was the modern safari industry which has captured this spectacular landscape and abundant wildlife in dream holidays of a lifetime somewhere between Out of Africa and an Attenborough documentary - with light aircraft landing in the bush alongside giraffes and zebras, getting close to cheetahs and lions, living in luxurious tented camps, with signature dishes and 24-hour protection by Maasai warriors. The price of this dream is 500 to 5000 USD per night.

Meanwhile, the Maasai communities around the Mara generally have an income of under 50 - 500 USD per month. It is because of their social norms and values that everyone has food to eat, a place to live in, clothes and medicines, and children’s school fees and uniforms are covered. It is also because of the Maasai cultural habits that there is so much wildlife in the Mara; the Maasai have always valued wildlife and conserved it – eating wild animals only in extreme conditions of starvation.

Questions of Social Value and Fairness Inevitably Come Up.

The principles of Natural Prosperity, require us to do more than just tinker at the edges of today’s economic growth model or expand the accounting structures and policies that help keep track of the health of our natural assets. It needs a profound shift in thinking, one that is about relearning how to value nature in our future economies and societies. In this third lecture in this series, I want to address the topic of how we value things universally and how nature fits into this.

Picture the scene; it is 1961 and I am looking at my new picture book Born Free by Joy Adamson – I still have it on my bookshelf. George Adamson, a game warden, was forced to kill a lioness that attacked him while trying to protect her three cubs. Two of the cubs were sturdy enough to be sent to a zoo, but the third cub, a small female they called Elsa was raised by the couple the cub and then trained to fend for itself in the wilderness. They knew that they had been successful when they left Elsa in the wild for a week and returned to find that she had killed a waterbuck, an African antelope. Elsa had three cubs of her own. In the two sequels — Living Free and Forever Free —she writes about Elsa's cubs: Jespah, Gopa, and Little Elsa. In early 1961, Elsa became sick and died and there is a marker on her grave in the Meru Game Reserve in Kenya. All three books were extremely popular, and films were made of each of them, starring Virginia McKenna and her husband Bill Travers. They were so moved by the Adamsons' work that they founded the Born Free Foundation in England to support wildlife conservation. The "Elsa" series have been translated into at least thirty-five languages; they provided the inspiration for zoologist Iain Douglas-Hamilton, a major activist working to protect the African elephant from extinction. The anthropologist Desmond Morris credits Born Free with affecting an entire generation's attitude towards animals. I know I was. Six decades later, I recognise the impacts, as I sit in the same world of the Kenyan savannah. Since then, David Attenborough has taken over this role, opening up our understanding of the lives of microorganisms, plants and animals and microorganisms for millions of people around the world.

The question is whether this greater understanding and knowledge of the non-human world will change people’s views about the value of nature in our economies and societies.

For this let me turn to Glasgow at the height of 18th century Scottish enlightenment, the dawn of the Industrial Revolution, and home of the father of modern economics Adam Smith. For many this period marks the rise of the Smith’s best idea, the idea of the invisible hand working through markets to create prosperity. Four centuries later, the world met in Glasgow at the COP26, the UN’s meeting of the Conference of the Parties, to turn what the Industrial Revolution had wrought into the Sustainable Revolution. Knowing how Smith’s moral sentiments turned into market sentiments, how societies values became equated with financial value and how this contributed to the credit, climate and covid crises hinges on our concept of value.

There are several the paradoxes of value. Great minds from Plato to Smith have considered why water, which is essential to life is virtually free, while diamonds which have a limited utility beyond their beauty. Why do financial markets consider Amazon the most valuable company while the real Amazon appears on no ledger until it is stripped of its foliage and converted into farmland. And how we can reconcile value, dedication and heroism of health care workers with their low wages and perilous conditions.

These are all issues of how we get what we value.

Concepts of values are rooted in philosophy and more recently and narrowly in economic and financial theory. Values and value are related but distinct. Values represent standards of behaviour, they are judgements of what is important in life – solidarity, humility, sustainability, resilience and dynamism. Value is the regard that something is held to deserve, its importance, its worth, its usefulness. Value is not constant, but rather specific to time and situation. The value of daily needs during the pandemic for example.

Over the centuries two broad schools of thought of what determines economic value have emerged. Objective and subjective value theories. Objective theories contend that the underlying value of a product is derived from how that product is produced and how that in turns affects wages, profits and rents. Proponents of objective value theory span Aristotle, Adam Smith, David Ricardo, Karl Marx – these last three classical economists lived during time of unpresented urbanisation, industrialisation and globalisation and they placed the growth and distribution of value squarely in the context of the enormous social and technical changes underway. They would have found alien, the widespread view held today that economics is a neutral technical discipline to be pursued in isolation of these dynamics.

Adam Smith’s produced two magisterial works. The Wealth of Nations, the most purchased, often cited but least read economics book, needs to be considered with its less read partner the Theory of Moral Sentiments. Smith writings warns of the mistakes of equating money with capital and divorcing it from its social partner. This misreading leads people to a portrait of Adam Smith as the father of laissez faire, where induvial have the freedom to transact business without any interference. But this is a caricature that grossly devalues this most considered and universal of the worldly philosophers of our modern world and fundamental concept of his works - the invisible hand. The central concept that links all Smith’s works is that continuous exchange forms part of all human interactions – exchanges of goods in markets, exchanges of meanings in language and exchanges of regard and esteem in the formation of moral and social norms. Smith believed that these norms are formed by wishing to be loved and to be lovely and well thought of and well regarded. We receive feedback from seeing how others perceive and judge us, we create incentives to achieve a mutual sympathy of sentiments. This leads people to develop habits and principles of behaviour. So moral sentiments are not inherent, they are as Richard Dawkins calls them, social memes that are learned, imitated and passed on. Like genetic memes they can mutate and go through behavioural cascades and tipping points.

Smith’s conception of markets, as with all his economics, must be seen in their broader social context, where markets are living institutions embedded in the culture, practice, traditions and trust of their day. Those markets determine the distribution of value, which he believed as did Ricardo and Marx who followed, is fundamentally derived from labour.

In the late 19th and early 20th centuries, the neoclassicists launched an upheaval in value theory as fundamental as Copernicus moving the Sun’s axis to its central position. They shifted the axis of value theory and the factors of production, such as labour, to the perceived value of goods to the consumer. From objective to subjective. According to the new group, people value goods that satisfy specific wants, so that it is only because people value these goods that the inputs are what is valued. Labour is thus not valued per se, but because the goods it helps to create is valuable. Value is in the eye of the beholder not in the sweat of the labourer.

In the century since, subjective value theory has gone mainstream and the combination of subjective value theory, in which price equals value and a cursory understanding of the invisible hand in which markets yield optimal outcomes supported by unseen and unchanging moral sentiments, promotes a view that all market outcomes equal value creation and that through them the growth of the wealth and welfare of nations. The concept of value, synonymous with economic theory a century ago, is now barely discussed.

With all that has gone on in the world over the past decade from the financial crisis, the increasing levels of risk from the loss of nature and change and now the effects of the pandemic on our world, we need a new debate on value.

We need to consider what is the right balance between markets, the state and the natural world, going beyond what Marianna Mazzucato has captured in her book the Value of Everything. Consider how our world has shifted over the last decades with markets gaining in stature and influence. The market is becoming the organising framework for economies and more recently for broader human relations, extending well into civic and family life. In parallel social constraints on unbridled capitalism have lessened. The Thatcher- Reagan revolution shifted the dividing line between markets and governments; the change in direction and reforms unleashed a new dynamism. With the fall of the communist regime, the spread of the market grew unchecked. By the 2000s, the conventional wisdom of market efficiency reigned supreme. Policy makers only had to listen and learn as the market was always right.

But when we grant an entity infinite wisdom, we enter the realm of faith. Faith can guide life but blind policy. Such cognitive capture led to the self-cancellation of policy maker’s judgement, as only the market knows. And such trust dictated that the only solutions to market failure were to add more markets or reduce regulation further.

What does a combination of social value and market fundamentalism encourage? What kinds of risks does it bring?

Social value theory at its core assumes an idealised world of perfect competition, commodity goods, complete markets and rational consumers and financiers. When these assumptions do not hold, a wedge is driven between social and private value. For example, when one or a few companies control a market, prices are too high and production too low. Or if markets are incomplete or suddenly lose resilience and collapse, small shocks can lead to widespread damage to asset prices or loss of jobs and welfare. Or when externalities, with costs benefits which we cannot control, individual actions can drive social disasters like the climate crisis.

The second area of risk concerns human frailties. Behavioural science tells us that we are far from making perfectly rational in decision making, often relying on past behaviours even if new information suggests they are wrong and thinking that examples are more common than they are. It is important that subjective values are time and context specific - water in a desert is essential, respirators in a Covid wing are critical. But if we value the present more that the future, then we are less likely to make the necessary investments today to reduce risks in the future even though they will end up costing less. Despite climate change evidence telling us what is happening today, we still did have not invested sufficiently and even though we knew about zoonoses, we did not prepare for a pandemic. These tragedies will not be fixed by addressing market imperfections alone.

The third profound area of risk comes from the drift from moral to market sentiments. The risks include the undercutting of the social foundations of the market, the corrosion of values arising from pricing of goods, services and civic virtues that have been traditionally outside the market and the flattening of values by forcing decisions to be made according to utilitarian calculations.

Take the drift in the nature of markets. Markets do not exist in isolation; they are a social contract partly determined by the rules of the state and partly by the values of society. They require the right institutions and the support of culture and maintenance of the social licence - values of trust, ethical customs, integrity and fairness – that are critical to market function. But these values have been taken for granted.

Where do these rules come from? According to economic and political philosophers from Smith to Friedrick Hayek, beliefs are part of the inherited social capital which provides the social framework for the free market. This social capital is the product of formal institutions and culture - including what Douglas North has referred to as incentives embodied in belief systems. Is the expansion of the market, which Milton Friedman and others have helped to unleash, changing the underlying social contract on which it has been based?

Could the emphasis on the individual over the community or on our selfish traits rather than our altruistic ones, imperil both the market’s effectiveness in determining value and ultimately society’s values – in other words if we move to a market society are we consuming the social capital necessary to maintain our natural assets and create the economic and human capital in the future?

The ethical customs we assume can change. And as we see, many are being corroded when financial returns are decoupled from their impact on other stakeholders. The importance of such moral sentiments is clear when companies seek to undertake green washing and hypocritical social window dressing in the expectation of attracting employee or increasing profits. This is how corrosion happens.

The spread of market mechanisms can corrode society’s values. We now seem to be moving into a hierarchy only based on wealth - a statuspshere built on money. Smith’s theory of moral sentiments says people form their norms and values by wishing to be well regarded, yet increasingly the value of an act is equated as its monetary value as determined by market. The logic of buying and selling no longer just applies to material goods but increasingly governs the whole of life including the allocation of healthcare, education, childcare, housework and environmental protection. Standard economic reasoning is that the spread of market exchanges increases efficiency without moral cost. But when everything become relative is anything immutable?

Michael Sandell, the philosopher, says that market value and reaching into areas previously not governed by market norms including environmental protection and civic life. There is considerable evidence that commodification - putting a good or service up for sale - can corrode the activity being priced. Money can crowd out civic norms. A moral error of many mainstream economists is to treat civic and social virtues as scarce commodities. This ignores that civic virtues can atrophy if not exercised; these grow like muscles with regular exercise. Virtue grows with practice. Solidarity during Covid was contagious. Offering money devalues community spirit.

The third risk is the flattening of market values – such as seeing welfare as the sum of all prices. This encourages growth today and crises tomorrow, allowing trade-offs such as profit and planet. This is compounded by subjectivism which implies that says that anything not priced is not valuable. It also affects encourages bringing more things into markets, a process that in turn affects perceptions of their value.

We need many more assessment of the costs and benefits of new policies that infer prices because there is not a market. But how robust are our estimates of the value of life? Our failure to put a price on social infrastructure and social capital can lead to underinvestment in what matters for wellbeing - GDP puts no value on government other than public sector salaries. But what captures performance during Covid – pay or heroic efforts. Similarly for environmental protection.

There are two ways to address the gap in these calculations - the utilitarian approach of Bentham and the welfarist approach of John Stuart Mill. Bentham defines utility as that property in any object that tends to give advantage, happiness or prevents mischief and pain to the party. The very idea of happiness – purely hedonic measures - are inadequate. Mill described what Bentham missed a sense of honour and personal dignity, duty, beauty, love of order, congruity, love of action and consistency in all things. Mill’s intuition is backed by extensive research into the science of wellbeing that shows that a wide range of determinants of human happiness are not priced - mental health, human relationships, dignity and the social climate. These can be hard to calculate but efforts to do this can be corrosive.

Distribution matters. Where there are large benefits for disadvantaged groups and only small costs for others, a policy may enhance welfare despite what market prices suggest. To many economists’ gift-giving is a loss of utility and efficiency. Cash-giving versus gifts fails to consider the stigma of norms against giving cash. Market value is considered to be intrinsic value. The price of everything is becoming the value of everything.

Many of the problems of climate change and the loss of nature began with the industrial revolution in Glasgow; many of the solutions reside in the sustainable revolution agreed in COP26 in Glasgow last year. Yet the losses of nature and species was downplayed because they had no value and the issue considered for another day. Now extreme weather evens are threatening assets worth 25-30% of global worth. Of course, GDP only measures the flows of that which is priced in the market - climate change is the curse that keeps on taking. But much of nature is not formally valued. Yet we know from Covid that undervaluing risk is placing more emphasis on sustainability for our health and the health of the planet.

Tackling climate change is a struggle and a balancing act between urgency and complacency – the urgency of carbon budgets that could be consumed within a decade and complacency to add more carbon through our purchase of cars and goods. The urgency of the looming sixth extinction of and the complacency of not valuing nature and the destruction of habitats and ecosystems. The urgency to reorientate the entire economic system and the complacency of most in the finance industry not having a knowledge of their own carbon budgets. These tensions reflect the common challenge of value: human frailties, market failures and the flattening of values.

These tensions reflect the three dimensions of value described earlier - human frailties, market failures and the flattening of values. Human frailties create a tragedy of the horizon – the catastrophic effects of climate change and nature loss will fall on future generations. Failure of markets creates the tragedy of the commons – leading to deforestation of the Amazon and the collapse of fisheries. Flattening of values – is how we have been trading off the planet against profit. Solutions do exist- for example, establishing community areas of protection and pollution controls. And fortunately, we are seeing coming out of Covid and COP26, that it is becoming costly to remain as part of the problem. Instead, prioritising resilience, fairness, justice and sustainability is what some parts of society now seem to be seeking.

Historically, many children’s stories were about what we should value: The Great Magi by O. Henry is one such example. It is about husband and wife, Jim and Della, who buy Christmas presents for each other, when they do not have much money to spend. Each has a special possession that they prize above all others: Jim has a gold watch that’s been handed down through the generations, and Della has her long, thick hair. Della sells her hair to buy a chain for Jim’s watch, Jim sells his watch to buy combs for Della’s hair. Although they both had gifts that each could not use, the love they showed each other was priceless.

But my sense is that putting a price on nature is a long way from valuing it. Valuing something comes from purpose, from striving to achieve something and the enjoyment of succeeding. Climbing Mt Everest is quite different from being deposited on the summit by a helicopter.

And as we saw during the first year of Covid, millions benefitted from the selflessness of others. and their efforts were valued by millions of others - it was a case of humans supplying humanity. - and a capacity to inspire others, a capacity to create and appreciate and value the efforts of others. Yet outside the context of Covid, the value of childcare and housework remains undervalued and poorly paid. Nor do we know how to add value to each other lives in a consistent and predictable way, because individuals are so different.

It seems that we need to refocus our education and economies on both the human world and nature - building on our understanding of the cognitive and emotional, rethinking education to support learning about how to live wisely and well, placing a high value on the interpersonal aspects of our lives and interdependencies in nature. Sadly, today we still send thousands of graduates out into the world, trained in management but with little knowledge of the people and living beings that they will manage.

If we think about what modern proponents of Keynes say about Universal Basic Services – it is about providing a reasonable income to every adult regardless of circumstance to use their time well. There is a distinction between the striving instinct (purposive) which is deeply embedded and will not disappear easily versus the instinct to take pleasure in direct enjoyment of things and today – the real values of life. We may now need to prepare for the art of life itself, to enjoy more leisure - the need to learn to enjoy the fuller perfection of life itself – to value the natural world and to educate people for this new world. Opposing this are those who believe in a system of work, where striving and enjoying are mutually exclusive.

Let me end by taking you back to the late seventeenth century and to a famous garden and a famous gardener. Both are best experienced in the early morning or late afternoon. In Padova, Italy, the Villa Barbarigo is a “philosophical garden”; it is a symbolic park which offers both a physical and an existential journey. Conceived by Cardinal Gregorio Barbarigo – later canonized by Pope John XXIII – and built by architect Luigi Bernini, brother of the famous Gian Lorenzo, the complex garden was laid out between 1665-1696. The Villa and its surroundings represent in all their grandeur the importance of the family and the gratitude to God for having saved the noble Barbarigo from the Plague. The garden is designed around an allegorical journey, conveying the positive message of a life where difficulties are faced and where there is always a solution; a life where, every now and then, it is good to stop and meditate; a life where time is precious and must be lived intensely, with joy, waiting for eternity. In this garden there is a 400-year-old Boxwood Labyrinth— likely to be the oldest one of its kind in the world— and a unique boxwood hedge walls which reach up to 5 metres high and trees between 300 and 900 years old and centuries-old specimens from four continents Asia, America, Africa and Europe. The journey between Nature and Art has remained intact over the centuries, where the beauty drawn by Mother Nature blends in great harmony with the beauty crafted by human hand. It is a spectacular garden, unpriced and unvalued in any kind of market, a testament to the value of a family.

At the same time, one of Great Britain’s most celebrated landscape gardeners, Lancelot ‘Capability’ Brown was hard at work. A revered designed, entrepreneur and salesmen, his nickname came from his fondness for describing country estates as have great ‘capabilities’ for improvement. His parklands celebrated Nature - they included rivers and lakes, plane trees and cedar trees from Asia and North America, in big open landscapes, with lawns up to the front door, and wild parkland up to the windows. Sometimes this need to bring wildness to the door meant that whole villages were uprooted and moved out of the sightlines. Today these landscapes are some of the most appreciated natural areas close to urban areas and country towns. Over the centuries, the owners have all been careful to protect and preserve these historically important landscapes and natural worlds; and unlike paintings which can be sold and moved around the world, none of these wild parklands have been destroyed or built over. They remain intact as indicators of an era when nature was valued by society.

As I end writing this lecture, I am sitting on the steps of my home embedded in a Capability Brown landscape watching the sun set over the expansive landscape of lakes and pastures, with sheep and birds circling all around me. In the summer the swallows nesting in the eaves will arrive from the Rift Valley. I feel connected between to my mud hut, wondering if the swallow I see there are the same ones. Capability Brown knew how to inspire a love of Nature amongst his clients – I wonder if we can do the same and enable the next generation to divorce the logic of a market society and recover the moral society.

As Sir David Attenborough says, “We are dependent on the natural world for every breath of air we take and every mouthful of food we eat: But it’s even more than that, we are also dependent on it for our sanity and sense of proportion.”

© Professor McGlade 2022

This event was on Tue, 11 Jan 2022

Support Gresham

Gresham College has offered an outstanding education to the public free of charge for over 400 years. Today, Gresham plays an important role in fostering a love of learning and a greater understanding of ourselves and the world around us. Your donation will help to widen our reach and to broaden our audience, allowing more people to benefit from a high-quality education from some of the brightest minds.

Login

Login