Professor Raghavendra Rau Appointed Mercers’ School Memorial Professor of Business

Gresham College, London’s oldest Higher Education Institution, and the Mercers’ Company are delighted to announce the appointment of Professor Raghavendra Rau as the Mercers’ School Memorial Professor of Business.

Rau is the Sir Evelyn de Rothschild Professor of Finance at Judge Business School, (University of Cambridge). He is a founder of the Cambridge Centre for Alternative Finance, arguably the world’s largest University research centre devoted to studying how technological change is disrupting the world of finance.

He has taught around the world, and also has industry experience as a former hedge fund manager.

He was also President of the European Finance Association in 2014 and has served as editor or on the editorial board of several finance journals. He has won several teaching and research awards and published on subjects ranging from bribery to behavioural finance, and corporate governance to corporate finance.

Professor Rau said: “I want to use this Professorship to help bridge the gap between how economists think about the world and how laypeople see the world. The disruption that’s going on in finance and business is something that we all need to understand, simply because it has the potential to upset our personal and professional lives.

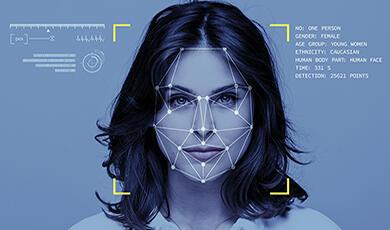

"Is crypto worth holding as an investment? Can corporations truly harness big data to make efficient inferences about you? What are the risks of using AI to spot frauds before they happen? These are some of the questions I would like to address in my first year lecture series.”

Dr Simon Thurley, Provost of Gresham College, said: “Technology is transforming the way finance works so it’s a brilliant time to have Raghavendra Rau come to Gresham to explain what is happening and how it affects us.”

Dr Wendy Piatt, CEO of Gresham College, said: “Professor Rau is a superb communicator with an outstanding teaching record, and we are delighted to welcome him to Gresham College.”

Login

Login